Modern State of Fertility 2020: Career & Money

Earlier this year, we partnered with SoFi to survey thousands of people with ovaries about how careers and money influence their plans for kids. Why? There’s been plenty of research on the impact of parenthood on our salaries and jobs, but far less exploring how our salaries and jobs affect our decisions to become parents in the first place.While analyzing the data, COVID-19 changed the world in ways no one could’ve predicted. We learned that money is the biggest motivator in delaying timelines — and with an unstable economy and millions of people unemployed, money’s on our minds now more than ever.

So, we sent a follow-up survey asking how the pandemic is affecting plans for pregnancy, and developed a tactical guide to navigating fertility decisions while facing financial stress based on advice from career coaches and financial advisors.Our hope is that by sharing data, stories, and advice, we can normalize conversations around money and fertility and use the knowledge to advocate for the futures we want.

Questions we set out to answer

Why are people putting off having kids?

Are people in certain professions more likely to delay kids?

Hypothetically, would people have kids later in exchange for a 20% raise?

What are the biggest financial hurdles for future parents?

How taboo is talking about fertility and money at work?

In their own words, how are folks mapping out their timelines for kids?

When it comes to having kids, cash is queen.

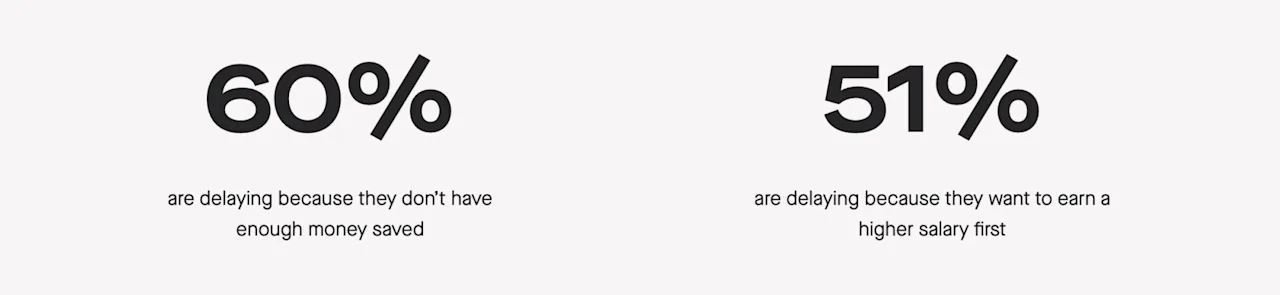

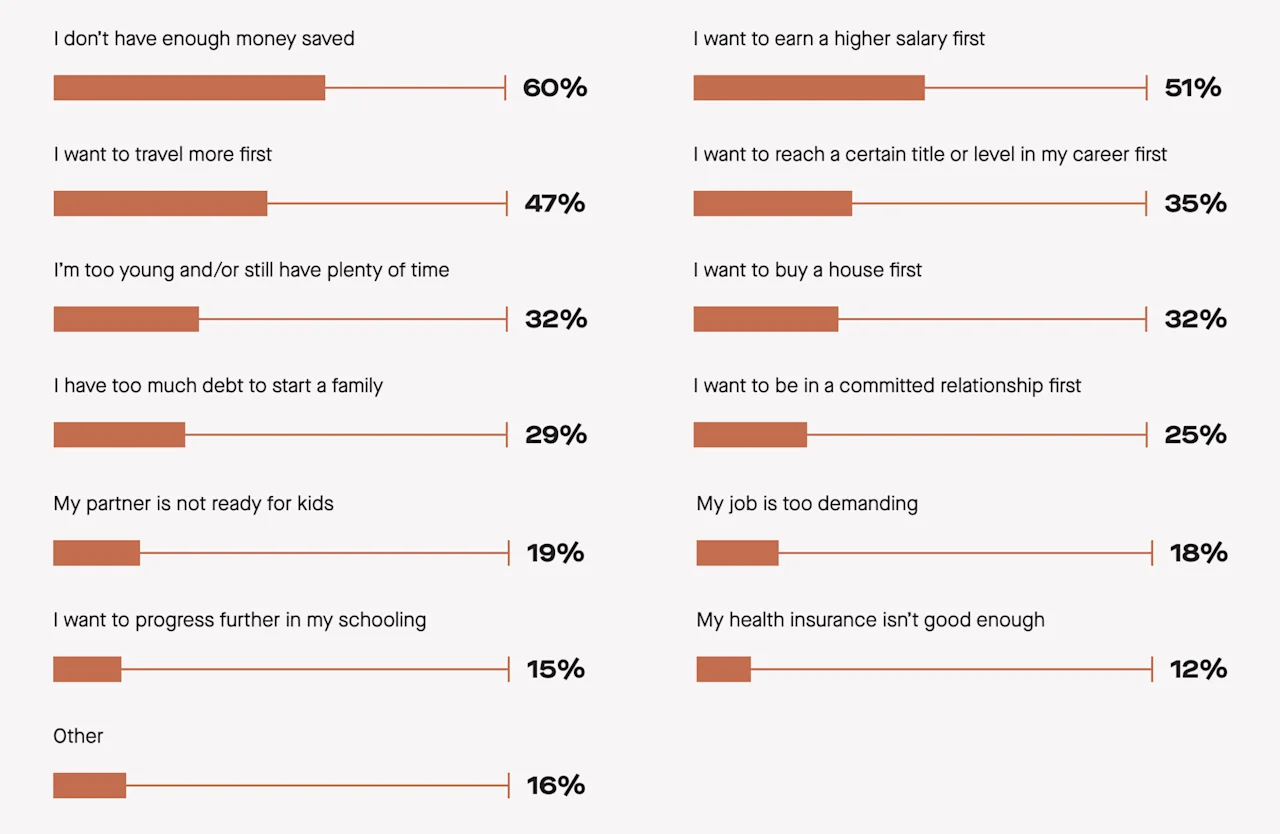

Almost half (49%) of the people we originally surveyed who want kids one day are delaying parenthood — and the top two reasons why were both money-related. Making time for travel came in third: 47% of respondents listed that as the most influential factor in delaying kids, over options like reaching certain titles and/or levels in their careers, buying homes, and working in jobs that are too demanding.

Why people are putting off having kids

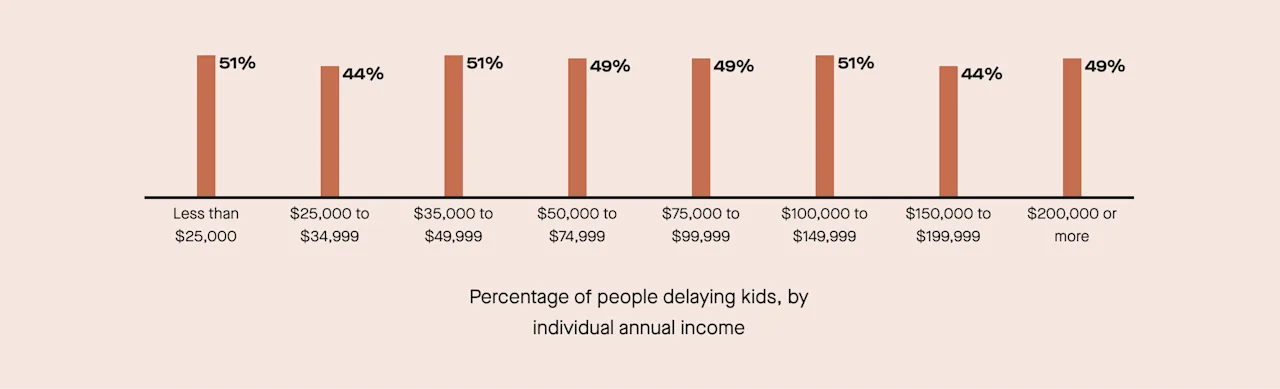

Individual income didn’t make much of a difference in responses — roughly the same percentage of people across all income brackets reported they’re choosing to delay having kids.

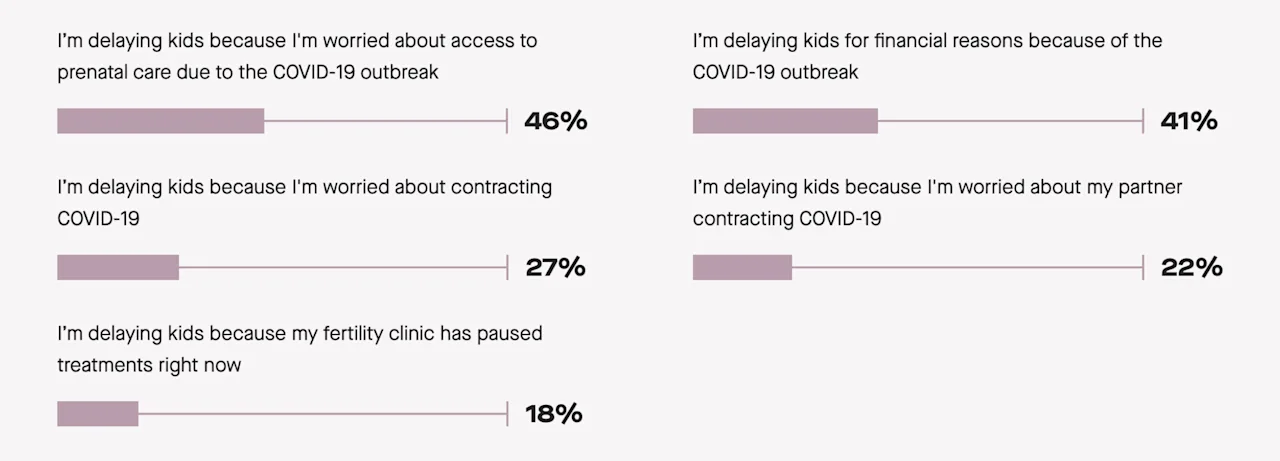

Nearly one-third of respondents have changed their fertility or family planning decisions due to the COVID-19 pandemic.

We reached out to a group of our initial survey respondents to see how COVID-19 is impacting their reproductive goals.

61% reported they’re more worried and anxious about their ability to have kids and family planning in general right now, and 31% said COVID-19 has changed their fertility or family planning decisions entirely.

COVID-19 related reasons why people are delaying kids

After pay, long hours and poor parental benefits are the two most influential workplace factors in delaying kids.

1 in 3 respondents from our original survey who said they’re delaying kids listed “working hours or pace that seem incompatible with parenting” and “poor parental benefits" (including parental leave, health insurance, infertility benefits, and childcare benefits) as the biggest job-related reasons for their decision. But we’re collectively making progress: Only 4% listed stigma around working parents or pressure from their bosses or co-workers as factors.

Workplace factors influencing the decision to delay kids

Sabrina, 32, registered nurse

"I delayed having more kids because I wanted more stability (meaning paying off more debt, buying a new car, and saving money). My hours working at night contributed to the delay. I know that I put a lot of stress on my body and I would need to change my diet habits and sleeping habits before more children."

Nicole, 27, lawyer

"Being a lawyer is a stressful career with unpredictable hours ... I knew I would delay having kids in my first two years of practice given the high-stress environment and the expectation that as a junior associate you are to be available at all times of the day."

Cindy Hernandez, 34, pediatric anesthesiologist

"I have definitely delayed having kids due to my career. Medical school and residency were grueling, and without a partner, I just didn’t think it would be a great idea to start a family alone without much support."

Ana, 32

"We thought waiting would be the best course of action, but now, knowing that the [COVID-19] pandemic is likely to last a long while — and not knowing how long it would even take us to get pregnant — we're wondering if we should keep trying."

Advertising, creative services, design, marketing, PR, and related professionals are just as likely to delay having kids as finance professionals — and both groups are more likely to delay having kids than doctors and lawyers.

3 out of 5 respondents who work in advertising, creative services, design, marketing, PR, and related professions are delaying kids — and “I want to reach a certain title and/or level in my career first” was the top reason why.

Just as many women working in finance (which includes investment banking, investment management, hedge funds, trading, retail banking, venture capital, private equity, or leveraged buyouts) are delaying kids, but cited “I don’t have enough money saved” as the top reason why. (It’s worth noting that half the finance professionals with that answer reported making $150,000 or more a year.) Finance professionals are also more likely to list “My job is too demanding” as a factor for delaying kids than other groups.

Percentage of people delaying kids, by industry

Percentage of people delaying kids, by job title

People who work at startups are only slightly more likely to report delaying having kids than those who don’t.

We gave respondents a few hypothetical scenarios: How long would they delay having kids for a raise, title bump, or complete student loan forgiveness?

Data represents the group of respondents who said they’d be willing to put off kids for these scenarios.

Kandace Proud, 41, marketing

"I’ve spent $15,000 on egg freezing and IUI to become a single parent — now, I can’t decide if it’s worth it to keep trying. I keep asking myself: ‘Do I spend the next $10,000 and try IVF? If that doesn’t work, do I call it a day?’ Becoming a single parent will definitely make my life harder. "

Jessica H., 33, project manager at software company

"It's difficult, being in my mid-30s, to make the decision to hold off on having kids, but since I haven't been at my job for over a year yet and we don't have the savings we would like, it is the most practical thing to do right now."

Anonymous, 34, marketing

"Getting out of school debt is the main [reason for delaying]. My husband and I both have $150,000 in school loans we’ve been paying down."

Anonymous, 27, healthcare

"I have thought of holding off due to a title change in my career as well as crippling student loan debt. I would feel bad bringing a child into a world when I can't give it everything it needs financially."

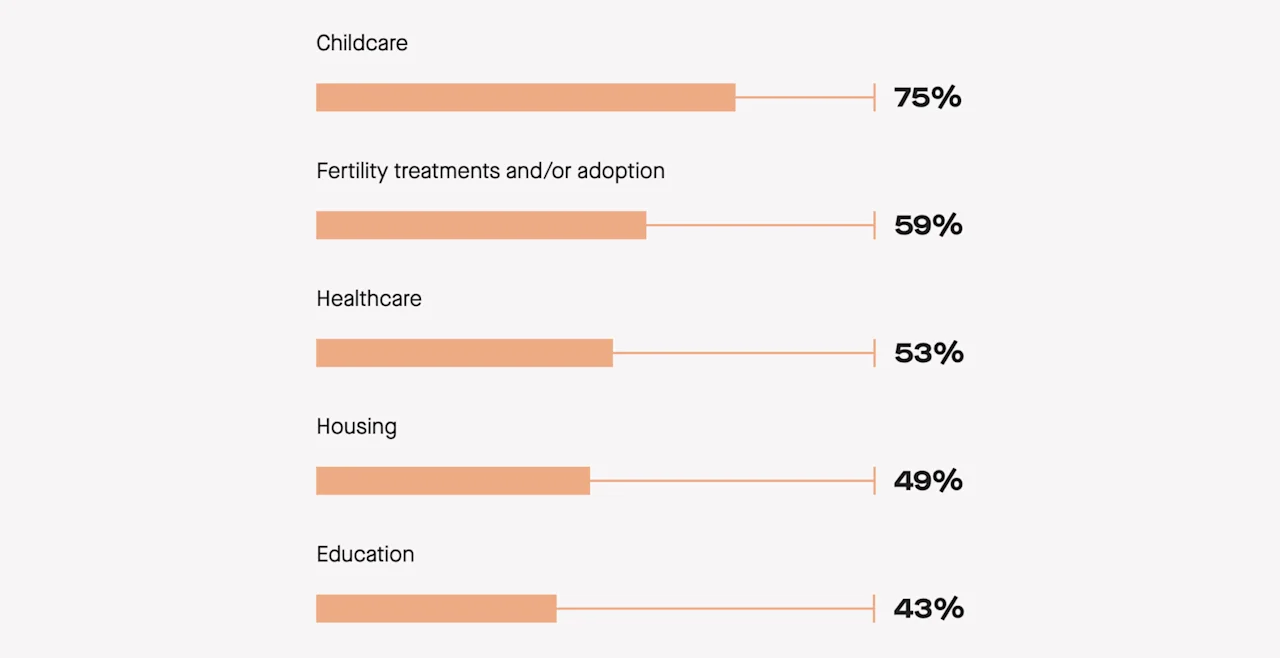

Paying for childcare is the biggest financial concern on people’s minds — runners-up are the costs of fertility treatments and adoption.

75% of people said they view childcare costs as the biggest financial burden of having kids, followed by the costs of fertility treatments or adoption, healthcare, housing, and education. Yet… almost half (46%) reported they aren’t currently saving up for parenthood.

Costs that weigh most heavily in the decision to start a family

Nearly half (46%) of people who want kids one day aren’t saving for kids or fertility treatments.

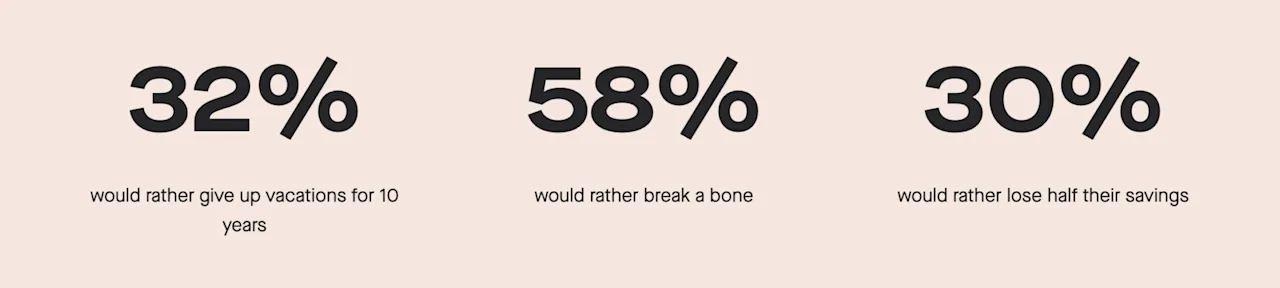

Hypothetically, what would people rather do than go through infertility?

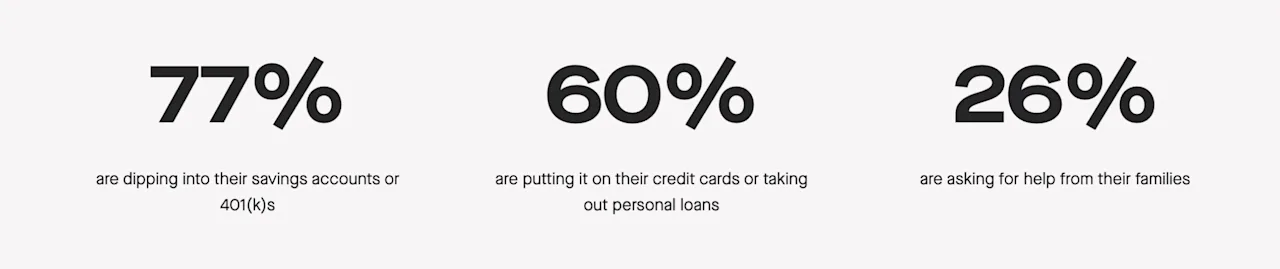

Fertility treatments can cost a pretty penny… but many people aren’t prepared to pay for them.

Nearly half (49%) of people who haven't yet paid for fertility treatments said, if necessary, they’d only be willing to pay up to $10,000. The reality is that fertility costs are much more than that: While costs vary by clinic, the average all-in cost for egg freezing is $17,000, and the average cost for a single IVF cycle is $23,000. (Source: FertilityIQ).

53% of people we surveyed who paid for fertility treatments spent between $10,000 and $39,999 — and 90% of these folks said they’d pay for fertility treatments over saving for retirement.

How people are covering costs for fertility treatments

For the LGBTQ+ community, there’s significant disparity between the perceived cost of fertility treatments and the actual cost. Our Modern State of LGBTQ+ Fertility found that 54% of LGBTQ+ respondents weren't aware that one cycle of egg freezing costs more than $5,000.

Precious, 29, entrepreneur and hearing officer

"I'm in a same-sex marriage and my wife and I have been trying to start our family for 2.5 years. During this process we had to pay for medical testing, sperm bank costs, ovulation kits, insemination tools, everything! It has been very expensive to fund our treatments: We paid $10K for IUI and then took out a $30K loan to begin the IVF process."

Courtney Yazzie, 29, customer education and content at a startup

"Being in a same-sex marriage, finances have definitely impacted our timeline to get pregnant. We both have jobs that would allow us to be pregnant and we both have great parental leave. Our careers are not roadblocks in and of themselves — the roadblocks come from the financial strain and the lack of insurance coverage for fertility treatments and procedures."

Anonymous, 32, business operations

"I delayed having children until now to focus on my career, as well as due to my fertility problems. Fertility specialists are not covered in-network under my insurance, and so it's costly for me to even seek out a fertility specialist, much less go through IVF or hormone shots."

Fertility conversations (even at work!) are becoming less taboo. The same can’t be said for convos about money.

Respondents said they’re more likely to share their plans for kids, experiences with infertility, and early pregnancy news at work than share info about personal debts or finances.

Here’s an interesting tidbit: People are about as open to talking about money as they are to crying at work.

How likely are people to talk about the following things at work?

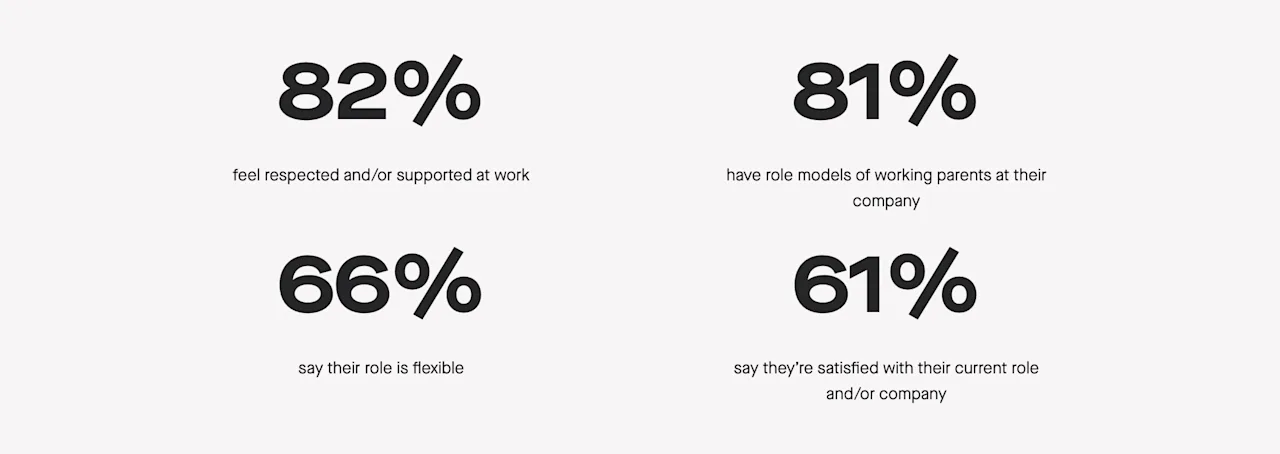

Over 80% of the people we surveyed have positive things to say about their workplaces.

We found a very bright spot in the data: The vast majority of people with part-time or full-time jobs reported they feel supported and respected, and they’re able to find great examples of working parents at their companies. (Woohoo!)

A tactical guide for tough times

Expert advice, data, and stories from 1,000s of women

Mapping out a timeline for having kids can be hard no matter what career you’re in, but an economic downturn further complicates plans. We developed the ultimate playbook for navigating fertility and career decisions while dealing with financial stress — it's full of tactical advice from SoFi, Career Contessa, Kunik, Fairygodboss, Tech Ladies, HerFirst100K, Empower Work, and others. Curious how people from different career paths responded to our survey? We’re also sharing data from 10 different industries and 1,000+ personal stories on delaying kids (or not), organized by job title.

In their own words

25 people on delaying kids

"I wanted to focus first on finishing my PhD, publishing, then my postdoctoral training, and by the time I finished that I was already 30. I also had to move a lot for my training and therefore I deprioritized my personal life and fertility planning in my 20s. Later on, I chose working in startups, including a very early stage one, which meant very long and unpredictable hours." — Milena, 35, scientist at a biotech startup

“After training for eight years to obtain my doctorate, and after waiting to get married after schooling, my husband and I just want to enjoy life together and travel and pay off our loans.” — Anonymous, 31, healthcare

“I don’t have enough time yet given work demands and my professional pursuit.” — Anonymous, 32, finance professional

“I was in a stressful job and felt close to promotion, so wanted to wait until I was settled into the new, higher-level role before starting to try for a family.” — Anonymous, 33, general management

“I'm at the point where I don't want to delay kids anymore, but the two things that are holding me back are my startup job does not have maternity benefits outlined and my husband's crippling credit card debt.” — Anonymous, 33, marketing

“Being an elementary teacher, it is almost impossible to save for anything, let alone kids — the long hours, stress, and emotional demand make me really think about whether or not I can handle being a teacher and a mom.” — Anonymous, 34, teacher

“The company I work for offers benefits that include freezing my eggs and a plush salary in reward for rigorous work and extended hours. Unfortunately, this has an implied pathway to delay my timeline for having kids. However, I feel empowered to be able to keep up with my male coworkers in my perceived professional advancement.” — Anonymous, 28, retail store manager

“As a woman doing well in my profession, I wanted to wait until I hit a certain level in my career. I had a lot of upward mobility that was happening quickly, and now I know things will take longer to get to the next level... so seems like a good time to have a kid.” — Anonymous, 30, tech

“Being 35, I'm actually really glad I've ‘delayed.’ I think getting further in my career, both in seniority and salary, puts me at an advantage at having children now vs. in my 20s. It has allowed me to work in a city with more opportunities for many years. It has also allowed me to develop skills I believe I can use to consult on my own and create my own schedule if I decide at some point that is best for my family and me.” — Anonymous, 35, marketing

“The career path I was on before my current employer was much more demanding, such as 15+ hour workdays for around nine months out of the year. Now my work schedule is about 12-hour workdays for about six months out of the year. My career and the time it demands is the largest factor for my choice to delay.” — Anonymous, 28, finance

“Having children as a trainee in medicine (as a student or resident) is not openly discussed. My medical school had no policy related to family leave, so I never told them I was pregnant for fear of ‘make-up’ work that I would never have had to do if I wasn’t pregnant. I was able to use time off that is available to students for other reasons, so was able to just show up later with a three-month-old baby. My residency had a draconian family leave policy that luckily I was able to update. There is no family leave policy at the national level for residents and fellows that permits time off other than vacation.” — Anonymous, 35, physician

“Having kids still sounds impossible. My life is comfortable right now, I love my job, have a great partner, and I am saving toward a house, but there's no parental leave at my job, my health insurance literally does not cover childbirth, I don't have extended family here to help, and childcare is expensive to nonexistent. If I do end up deciding to try to have a child, it will be extremely difficult and mean significantly reducing my quality of life.” — Anonymous, 34, researcher/scientist

“I do not feel established enough in my career to walk away if I had to in order to raise a child. At my current position, you are expected to be available around the clock for your clients and work under extreme pressure/deadlines. If I were more established/comfortable in my career, I would be more open to having children.” — Anonymous, 30, advertising, media, public relations

“Hoping to be elevated to a higher position and earn a higher salary before having kids because I’m afraid it won’t happen after I have kids. I’m concerned my boss will assume I don’t want challenging assignments or added responsibility after having kids.” — Anonymous, 33, entertainment/media

"I am turning 29, and the fact that I only have six years left of 'healthy fertility' is weighing very heavily on me. I feel a lot of pressure to have children as soon as I possibly can because I don't want to be high risk when pregnant or do anything to jeopardize the health of my future child. Therefore, the job piece will come second. I need a paycheck to survive, but being a mom is much more important to me. I can always find a way to make ends meet if needed." — Anonymous, 28, customer support

“I choose to delay mainly because I deal with a lot of funders and it just appears very frowned upon when women in leadership are pregnant. I feel like my Board of Directors and funders would think that I was less capable of doing my job. As a woman of color I still continue to have to work two times harder for the people around me to believe in me. Being pregnant would make me feel as if I’m discredited in my position.” — Anonymous, 31, non-profit

“Truthfully, I'd like my company (being a startup) to be a little bit more established and my job a bit more secure before considering having kids. I'd also like to be a level higher than I am (director) as I feel it would be easier to make the jump from director to VP as a mom then it would be to jump from senior manager to director as a mom.” — Anonymous, 30, human resources

“I’m strongly considering egg freezing this year due to my age, but I have a new partner who may feel rushed if I bring up family planning together now.” — Anonymous, 37, business operations

“I’m actually pregnant now and had to quit my executive position because I didn’t work for a company that supported working mothers and also didn’t offer any maternity benefits.” — Anonymous, 39, general management

“I chose to delay having kids, and consider not having them at all, because of my student loan debt. I just can't imagine bringing a kid into the world without being able to give them everything they deserve and have a comfortable life. I think our generation is less concerned with career advancement and more concerned that we can just never afford a house or children because of the state of debt we've been left in.” — Anonymous, 29

“I have significant student loan debt that I’d like to have paid off before starting a family. There can be so many unexpected costs when raising kids and I want to be prepared.” — Anonymous, 33, physician

“For a long time I was on the fence about kids. When my partner and I decided we want kids, I had just finished grad school and started a new job. Grad school ate up my savings, I owe a lot in loans, and I need time to get settled in my job.” — Anonymous, 32, data scientist

“I delayed kids because advancement in my career was more important and having kids can delay promotions.” — Anonymous, 36, business operations

“I thought I was ready when I was 30, but then we were hit by the Great Recession and [my husband and I] went to graduate school to improve our future prospects and supplement our income with school loans during that time. By the time we were both finished with our degrees and ready to begin TTC, I was 37. We have been working through infertility for nearly 6 years now.” Anonymous, 42, administrative support

“I am constantly torn between seeking a new job with more future potential and better benefits that would require moving (likely closer to family) or staying in my comfortable, well-paying, pretty flexible job with a great boss to save up more before starting a family. It feels like I have to put my career on the back burner and have kids or wait several more years to have more financial security.” — Anonymous, 30, designer

13 people on not delaying kids

“At my age, I feel high pressure to have kids regardless of what is going on in my professional life, which is quite stressful. I feel that no matter what is happening, I just have to either have a kid now or not.” — Anonymous, 40, advertising

“I just received a big promotion and knew the next one wouldn’t be for at least another two years. At the same time, my husband was feeling settled in his job, and we knew we were going to be in Houston for the foreseeable [future]. So we thought it was the right time to start trying.” — Anonymous, 31, consultant

“Because of my age and the size of the family that I desire, I have no problem accelerating my timeline. To me, work comes secondary to raising children. No amount of job success could replace that for me.” — Anonymous, Marketing, 31

“I accelerated trying to conceive by about two years out of fear that I wouldn't be able to.” — Anonymous, 31, product development

“We found out pretty early (at age 25) that fertility was going to be a struggle for us. That accelerated our family planning timeline because we knew we wanted kids, even though we hadn’t done what we wanted financially or in our careers yet. Eight years later, I am currently expecting our third child. It’s been a wild ride, but we are so grateful for our growing family and that our fertility condition was a treatable one.” — Anonymous, 33, healthcare

“I decided to accelerate having children because I grew up in a large family. I loved the idea of having my own and making memories as a family.” — Anonymous, 29, customer support

“I don’t let my career dictate my family planning. My main issue has been finding a partner with whom I would want to start a family.” — Anonymous, 34, consultant

“I am actively trying to have children with my husband — we have suffered a miscarriage and an ectopic pregnancy. I do not think work is more important than family and I would quit my job in a heartbeat to have children.” Anonymous, 31, healthcare

“Having a family has always been my top priority, so I have not delayed in that aspect at all. My husband and I have done everything that has been recommended by our doctors to help grow our family.” — Anonymous, 26, teacher

“Honestly, my career is in a good place. And the organization I work for is very flexible and family friendly. I have had multiple miscarriages in the past and really struggle with the thought of getting pregnant again and having another miscarriage. I’m at the age where I’m constantly asked when am I going to have a baby. I go back and forth with trying again or just accepting that it may not happen to me.” — Anonymous, 32, nurse

“Got married at 32, had a miscarriage at 33, and now I’m 34 and still haven’t conceived again yet. My only purposeful delay was waiting until we were married to get off birth control. The rest has been delayed due to circumstances out of my hands.” Anonymous, 34, human resources

“When I realized that there were no real options for career advancement and no real benefits to putting in extra work, I decided I would not put off having kids for the benefit of my employer any longer.” — Anonymous, 31, lawyer

“My reason for waiting to have kids is I just always wanted to be 30 when I became a mom. I'm getting married this year and want a year or so with my wife before we start trying. Work doesn't really have anything to do with my decisions about timeline for having kids.” — Anonymous, 28, product manager

We make personalized fertility information and support more accessible for people with ovaries. Now part of Ro, we offer fertility essentials — including at-home tests and tools — that help you get proactive about your reproductive health.

SoFi helps people achieve financial independence to realize their ambitions. Their products for borrowing, saving, spending, investing, and protecting give their more than one million members fast access to tools to get their money right. SoFi membership comes with the key essentials for getting ahead, including career advisors and connection to a thriving community of like-minded, ambitious people. For more information, visit SoFi.com or download their iOS and Android apps.

Methodology

This trend report was conducted in February 2020 as a cross-sectional survey of nearly 2,000 people to examine the experiences that they have related to fertility and their careers. We conducted a follow-up survey of 406 people in April 2020 asking about the impact of COVID-19 on their reproductive goals.A cross-sectional survey means that we gathered the data at a single point in time and did not attempt to change or alter their beliefs in any way when gathering the data. What can (and can’t) this type of study tell us? A cross-sectional survey is a great way to learn about the number of people who have made different fertility decisions. This type of study can’t tell us anything about causation.

Demographics

2,116 participants total; 1,894 participants were used for data analysis

Age range: 20-45 Mean age: 32 (SD: 4.89)

Gender identity | # |

|---|---|

Cis female | 1886 |

Cis male | 206 |

Nonbinary | 6 |

Trans female | 0 |

Trans male | 4 |

Gender queer | 1 |

Gender nonconforming | 1 |

Intersex | 0 |

Prefer not to say | 12 |

Racial/ethnic background | # | % |

|---|---|---|

American Indian or Alaska Native | 31 | 2% |

Asian | 185 | 10% |

Black or African American | 163 | 9% |

Native Hawaiian or Other Pacific Islander | 11 | 0.6% |

Hispanic or Latina | 224 | 12% |

White | 1345 | 71% |

Middle Eastern | 27 | 1.5% |

Prefer not to say | 41 | 2% |

Note: Participants were able to select more than one racial/ethnical background option. The table indicates the total number of participants that indicated each race. The total will add up to more than the total number of participants because they could select more than one.

Sexual orientation | # | % |

|---|---|---|

Heterosexual or straight | 1665 | 87.9% |

Gay or lesbian | 27 | 1.4% |

Bisexual | 94 | 5% |

Asexual | 6 | 0.3% |

Queer | 21 | 1.1% |

Prefer not to say | 11 | 0.6% |

Other | 6 | 0.3% |

What is your current employment status? | % |

|---|---|

Employed full-time | 82% |

Freelance/contractor | 5.8% |

In school | 5.2% |

Employed part-time | 5% |

Unemployed and currently looking | 2.7% |

Unemployed and not currently looking | 2% |

Retired | 0.2% |

What is your current individual annual income? | % |

|---|---|

Less than $25,000 | 8.5% |

$25,000 to $34,999 | 8% |

$35,000 to $49,999 | 13.4% |

$50,000 to $74,999 | 25.2% |

$75,000 to $99,999 | 17.9% |

$100,000 to $149,999 | 17% |

$150,000 to $199,999 | 5.6% |

$200,000 or more | 4% |

What is your current relationship status? | % |

|---|---|

Married | 49.7% |

In a committed relationship or partnership | 23.8% |

Single, never married | 15.3% |

Engaged | 8.1% |

Divorced | 1.7% |

In an open relationship | 0.6% |

Other | 0.3% |

Prefer not to say | 0.2% |

Widowed | 0.1% |