Here's what we'll cover

Here's what we'll cover

Healthcare costs add up quickly. From prescription refills to unexpected trips to the emergency room, payments can all but (and sometimes do) wipe out your savings. One way to get ahead of the financial burden is to make sure you’re taking full advantage of your HSA (Health Savings Account) or FSA (Flexible Spending Account) by using them correctly.

HSAs and FSAs are handy accounts that you contribute to, tax-free, to save up for healthcare costs. Understanding how these accounts work can help you plan, save money, and make the best decisions you can for yourself and your family.

What you’ll learn:

The difference between an HSA and an FSA

Which health-related eligible expenses HSAs/FSAs cover

How you can use your HSA or FSA with Modern Fertility (!)

How real people have put these accounts to use

HSA or FSA?: The basics

Both HSAs and FSAs allow you to set aside pre-taxed dollars from your paycheck to use for eligible medical expenses, but that's where the similarities end.

The HSA rundown

How do you qualify for an HSA?You must have a high-deductible health plan. According to HealthCare.gov, a high-deductible health plan for 2022 is any plan with a deductible of at least $1,400 for an individual or $2,800 for a family.

Not all plans with deductibles over these limits qualify for HSAs, so it’s important to check with the insurance company before you make any decisions.

Your high-deductible health plan must serve as your only medical insurance plan, and you must not qualify for Medicare, Medicaid, or be claimed as a dependent on someone else’s tax return. You don't have to go through your employer to qualify, though — you can purchase your health plan on your own.

How much can you contribute to an HSA in 2022?The 2022 contribution limits and out-of-pocket costs are as follows:

An individual with coverage under a qualifying high-deductible health plan (deductible not less than $1,400) can contribute up to $3,650 — up $50 from 2021 — for the year to their HSA. The maximum out-of-pocket has been capped at $7,050.

An individual with family coverage under a qualifying high-deductible health plan (deductible not less than $2,800) can contribute up to $7,300 — up $100 from 2021 — for the year. The maximum out-of-pocket has been capped at $14,100.

Keep in mind you can only withdraw what you’ve already contributed. If you have a health emergency and you’ve only contributed $1,000 by that point in the year, that’s all you can use from your HSA.

When can you change the amount you contribute to an HSA?You can make any adjustments during open enrollment, if your family situation changes (i.e. you have a baby), or if you get a new job or a new insurance policy.

What happens to your HSA funds at the end of the year?Any unspent money will roll over so you can use them the following year.

The FSA rundown

How do you qualify for an FSA?FSAs are available only as part of a benefits package from an employer, not if you’re on your own — but the medical expenses you can use them for are the same as with HSAs. There are no eligibility requirements for an FSA beyond being employed, but self-employed folks and freelancers don’t have the option to set up an FSA.

How much can you contribute to an FSA in 2022?In 2022, you can save up to $2,850 in your FSA (this is $100 more than 2021). You determine an annual allotment, divide that by the number of pay periods you have in a year, and that amount will be deducted each period and put into your FSA account. Then, you can dip into the savings whenever you need to.

When can you change the amount you contribute to an FSA?You can make adjustments anytime, but you can't go over the limit of your contribution ($2,850 annually).

What happens to your unused FSA funds at the end of the year?Right now, because of the COVID-19 pandemic, the IRS is allowing all unused FSA funds to roll over into 2022. Check in with your unique plan for the details.

Note: There’s also something called a Dependent Care FSA (DCFSA), which is a pre-tax benefit account used to pay for dependent care services, such as preschool, summer day camp, before or after school programs, and child or adult daycare — which has its own set of rules and requirements.

How much should you put in your HSA or FSA?

Before deciding how much to set aside, here are two of the best ways to manage your flexible spending account:

Consider your health insurance premiums and deductibles. What are your monthly or expected healthcare costs? You may want to plan to contribute the entire amount of your annual deductible.

Calculate the costs of your regular, yearly doctor appointments. These costs can help you set a baseline for your HSA or FSA contributions. Because details might vary based on your specific health insurance plan or employer, make sure you do your research before counting on that money.

If your company has an HR department, they might be able to offer you some advice. Both options help you manage those out-of-pocket costs and will save you money since your contributions are tax-free.

What expenses are actually HSA/FSA eligible?

Check out FSAstore.com and HSAstore.com for the full lists of eligible expenses. No matter which type of spending account you get, it’ll cover:

Insurance : The amount you pay before your health insurance provider begins to cover the costs of medical services.

Copayments: The amount you pay each time you visit a healthcare provider.

Coinsurance: A percentage of the costs of medical care that you pay after your insurance company has chipped in.

Prescription drug costs: What you’re charged each time you get prescribed a new medication or have to refill an existing one.

But wait, there's more! HSAs and FSAs can cover women’s health costs, too

On top of deductibles, copays, and trips to your local pharmacy, your spending account can also pay for expenses related to managing women’s health. As part of the Coronavirus Aid, Response and Economic Security (CARES) Act signed into law at the end of March 2020, you can now use HSAs or FSAs to pay for over-the-counter medications without a prescription as well as menstrual care products (like tampons and pads), as eligible medical expenses. These are permanent changes and will apply retroactively to purchases beginning January 1, 2020.

Here are some of the costs you can expect to use your HSA or FSA for (though you should definitely investigate the details of these with your own insurance company):

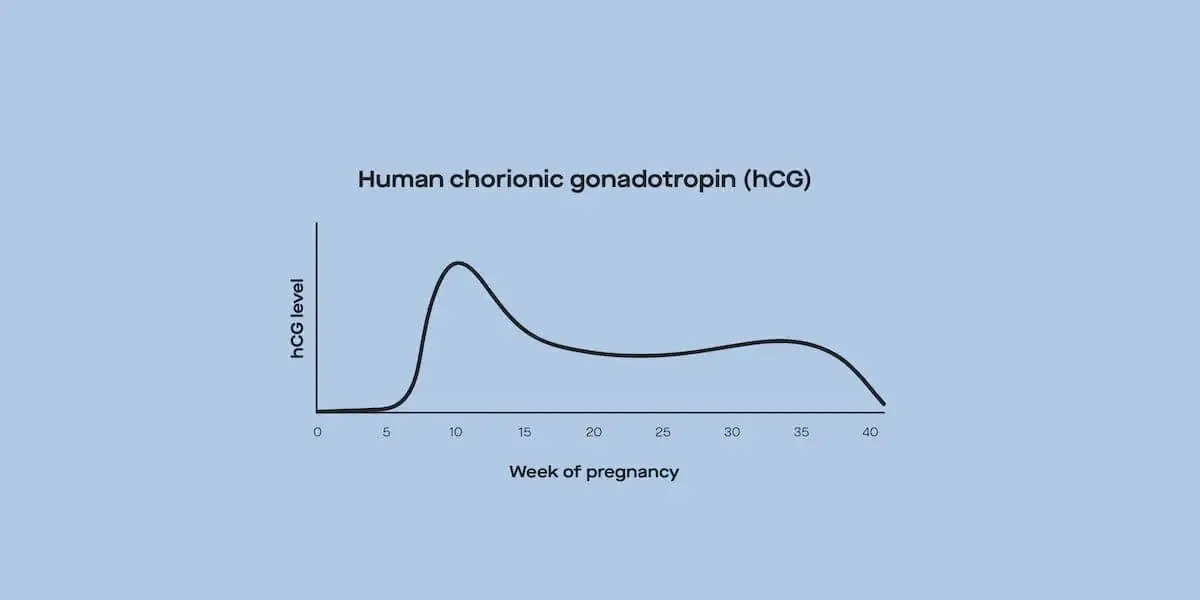

Home fertility tests

Menstrual products – like menstrual cups, tampons, and pads

Many methods of birth control, including pills, contraceptive patches, vaginal birth control rings, IUDs, spermicidal creams, and condoms

Expenses associated with legal abortions

Breast/chest reduction (but only with a physician's diagnosis)

Expenses related to infertility, like donor egg extraction, egg/embryo/sperm storage, IVF, sperm washing, and surrogacy

Hormone replacement therapy (HRT)

Any vitamins taken for a medical condition

Mental health counseling

Yoga (but only to treat a medical diagnosis)

Gym memberships

Over-the-counter items, such as acne products and pain relievers.

HSAs and FSAs, IRL

Before the Patient Protection and Affordable Care Act (ACA), funds that weren’t used by the end of the year were forfeited. This was colloquially known as the "use it or lose it" rule. And now, because of the pandemic, both HSA and FSA funds are eligible for rollover into 2022.

If you’re reaching the end of the year and have untouched funds in your account, think about anything you've been putting off. Those might just be things you can use your HSA or FSA to cover.

Here's what some people used their remaining funds for:

Rachel, a marketing manager in Tennessee, managed to submit her dog’s treatment for coverage by her FSA. “Back when I had an FSA (about six years ago), I was able to use it to pick up prescription drugs for the dog at Walgreens. She was on prednisone and a couple of other medications. I was able to have the vet call into Walgreens to save us money. I bought a pill cutter to cut pills down to the sizes they needed to be, and just filled [the prescriptions] at Walgreens. I was able to submit the receipts to FSA with no questions. It was extremely helpful during a (very expensive) long-term illness.”

Melissa, a Nashville-based architect, plans an end-of-the-year shopping spree. “For the last two years, I’ve gone to the pharmacy on New Year’s Eve and bought condoms, band-aids, vitamins, and contact solution to empty our family’s FSA. (The cashier is always surprised when I show up with baskets full of condoms.) Before [my son] was potty trained, we even used the funds for diapers and pull-ups!”

Now that you’re fully versed on everything HSA and FSA, what will you do with those pre-taxed dollars?

DISCLAIMER

If you have any medical questions or concerns, please talk to your healthcare provider. The articles on Health Guide are underpinned by peer-reviewed research and information drawn from medical societies and governmental agencies. However, they are not a substitute for professional medical advice, diagnosis, or treatment.