Here's what we'll cover

Here's what we'll cover

Here's what we'll cover

In 2026, Ro is running our first Super Bowl ad. It will feature Serena Williams and her amazing journey on Ro — her weight loss, her improved blood sugar levels, her reduction in knee pain, and the overall improvement in her health.

As I’ve shared the news with friends and family, the first question they ask, after “Is Serena as cool in person?” (the answer is unequivocally yes), is “How much did it cost?”.

$233,000 per second, minimum, for the air time — excluding all other costs. When you first hear that a Super Bowl ad costs at least $233,000 per second, it’s completely reasonable to pause and question whether that could ever be a good use of money. On its face, the price sounds extravagant — even irrational. And without context, it often is.

But once you break down the economics, the decision starts to look very different. The Super Bowl is not just another media buy. It is a uniquely concentrated moment where attention, scale, and cultural relevance align in a way that doesn’t exist anywhere else in the media landscape. That alone changes the calculus. This leads us down a fascinating discussion of the economics behind DTC advertising, brand building, and the production of the spot.

After having the conversation a few times, my co-founder Saman and I thought it would be helpful to put together a breakdown of how we thought about both the economics of and the making of our Super Bowl ad. To check out “The making of Ro’s Super Bowl Ad,” head over to my co-founder Saman’s post here.

Of course, some brands will approach it differently, but I think this could be a helpful example for the next Ro that is considering running their first Super Bowl ad.

Let’s dive in.

WHAT MAKES A SUPER BOWL AD SO UNIQUE?

1. Ads are part of the product

For most advertising, it is an interruption. Viewers want to get back to the product (e.g., a TV show, sporting event, or even access to the wifi on a plane!). Even the best ads are still something you tolerate on the way back to the content you actually want.

There is exactly one moment each year when the incentives of advertisers and viewers are perfectly aligned. For a few hours, on a Sunday night in February, more than 100 million people sit down and are excited to watch an ad. They aren’t scrolling TikTok. They aren’t going to the bathroom. They are actively watching…ads.

People rank Super Bowl ads. They rewatch them. They critique them. They talk about them at work the next day. The Today Show plays them…during the show as content, not as ads!

That alone makes the Super Bowl fundamentally different from every other media moment in the year. It’s an opportunity, unlike any other, to capture the hearts and minds of potential (and sometimes existing) customers.

2. Opportunity to compress time

No single commercial builds a brand. Advertising alone doesn’t create a brand. The best brands are built over time. They are built by the combination of a company making a promise to a customer (e.g., an advertisement) and then delivering on that promise time and time again (i.e., the product).

Commercials are one way to make that promise. To share with the world what you’ve built and why you think it could add value to their life. To make them “aware” of what you do. This takes time. It takes repetition. It often takes multiple touchpoints. Again, this is why the first takeaway about people paying attention is so important — they might need fewer touchpoints if they are “actively” watching.

The Super Bowl can compress the time it takes for people to be “aware” of your brand. Of course, you still have to deliver on that promise with a great product. But in one night, you can move from a brand most people have never heard of to one your mom is texting you about.

There is no other single marketing opportunity that can accomplish this. With today’s algorithms, even what goes “viral” might be only in your bubble.

During the Super Bowl, we all share the same bubble.

The NFL accounted for 84 of the top 100 televised events in 2025 (including college football, it was 92). The NFL and maybe Taylor Swift are the only remaining moments of a dwindling monoculture.

Last but not least, the Super Bowl is the only moment where you can speak to ~100 million people at the same time. In 30 seconds, you can reach an audience that would otherwise take years—this is what it means to compress time.

3. There is asymmetric upside

While the decision to run a Super Bowl commercial is not for every company, for the universe of companies for which running an ad could make sense, the financial risk profile is misunderstood. This is not a moonshot. It’s a portfolio decision with a capped downside and asymmetric upside.

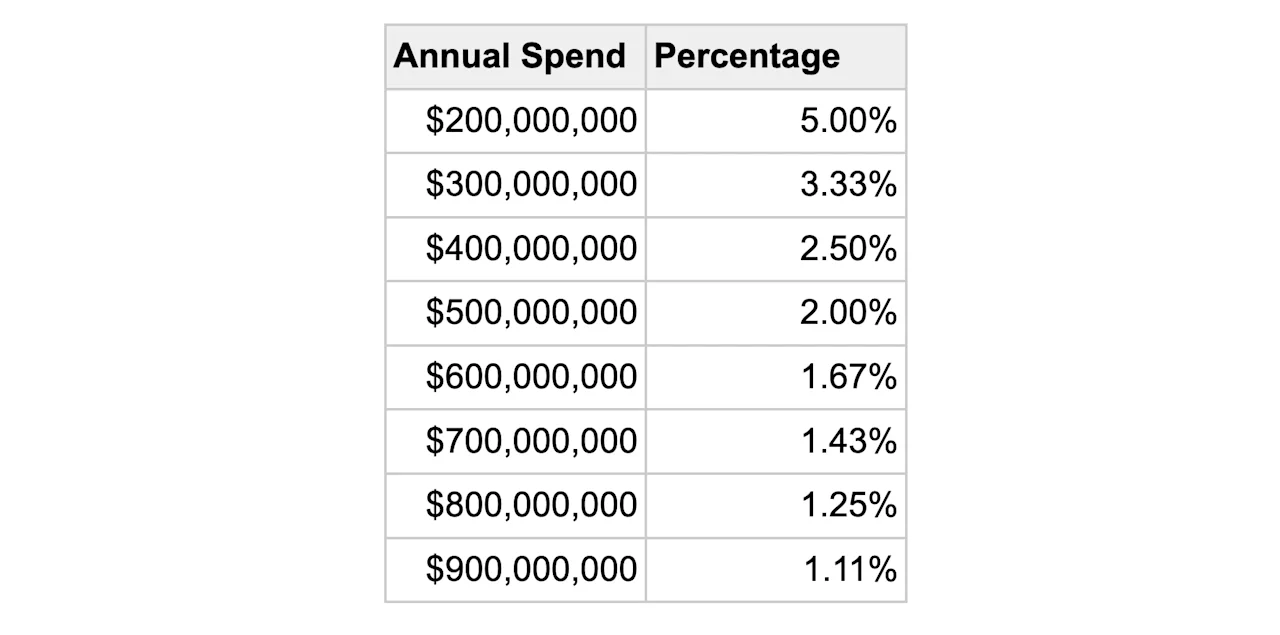

Imagine you’re a company spending nine figures annually on marketing, a Super Bowl ad is a single digit percentage of your spend. We’ll get into the exact math down below on the cost of an ad but let’s just use a rough $10M number here for illustrative purposes.

At worst, if the ad does absolutely nothing to help your company, literally zero, it decreases the efficiency of your entire marketing budget by 1-5%. Again, this is rough, hand wavy math here. I’m doing it to emphasize that the financial downside is fairly capped.

But the upside, that is relatively uncapped. A great Super Bowl ad can:

Increase brand awareness and compress years of advertising

Drive immediate customer acquisition

Drive efficiency in future advertising

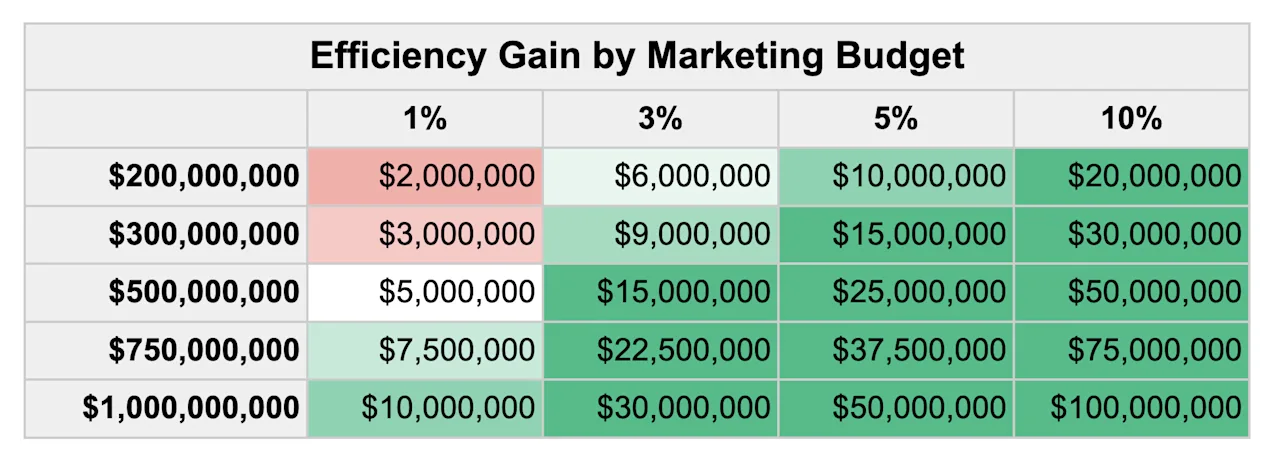

The last point, “drive efficiency in future advertising”, is where a large part of the asymmetric upside can come from. Increased brand awareness and affinity can increase the efficiency of all future forms of advertising (e.g., TV, Social, Search, Audio etc.). What if it made a company’s future spend of 2%, 5% or even 10% more efficient? What if it had that impact for the next 3 months? What about 6 months or a year?

Which brings us to the real work. We’ve set up why this moment is unique from an advertising perspective. But what needs to be true for that unique moment to be worth the investment? To understand whether this makes sense, let’s look at:

The full cost

How success is actually measured

And the math required for this to be a good decision

WHAT IS THE (FULL) COST?

The fully loaded cost of a Super Bowl ad varies by:

Initial ad cost

Production cost

Accompanying ad-spend requirements

For the purposes of this discussion, we’ll exclude internal technical resources devoted to scaling our platform infrastructure for the Super Bowl.

Initial Ad Cost

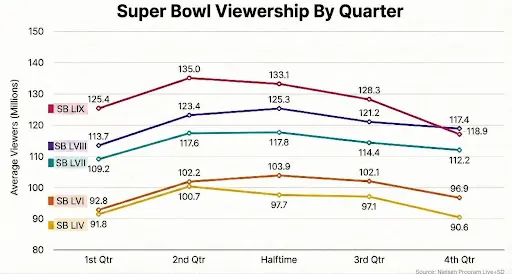

On average, every 30 seconds of advertising time in the Super Bowl costs ~$7M-10M (source) . This can increase with supply-demand dynamics. For example:

The later in the year you buy the ad, the more expensive it can be (i.e., inventory decreases)

The location of the spot in the game can impact the price someone is willing to pay

Given that viewership in the Super Bowl is not even across the duration of the game, premiums may be required to be in key spots early in the game, or adjacent to the beginning of Halftime when viewership is often at its highest

If a brand wishes to have category exclusivity (i.e., to be the only Beer brand advertising in the game), that would come at a premium

First time or “one-off” Super Bowl advertisers may pay higher rates than large brands who are buying multiple spots, or have a substantial book of business with the broadcasting network

Note: if companies run a 60 second ad, they have to pay 2x the 30-second rate. There is typically no “bulk discount” as there is no shortage of demand. Any company that wants to pay for 60 seconds needs to buy two slots because the second 30-second slot could easily be sold at full price to another company.

Production cost

A high-level rule of thumb for production costs relative to ad spend is to allocate 10-20% of your media budget towards production. The Super Bowl, however, usually breaks that rubric for a myriad of reasons.

A typical Super Bowl will cost ~$1-4M to produce, excluding “celebrity talent.” This cost bucket would cover studio/site costs, equipment, production staff, travel, non-celeb talent, director fees and post-production editing and sound services. Again, this is a range based on the conversations I’ve had with companies that have run several Super Bowl ads.

Generally speaking, the caliber of production required to execute a Super Bowl spot (particularly with celeb talent) will lead to higher costs here than a standard, run-of-the-mill TV production

I expect this to go down over time with AI

There are some historic examples where the production cost was likely far less (e.g., Coinbase QR code)

Last year, 63% of all Super Bowl ads included celebrities (source). There are a variety of factors that will influence the cost of “talent.”

How well known and trusted is the celebrity?

How many celebrities are included?

What’s the product? Crypto ads now might have a risk-premium attached after FTX

What are you asking them to do / say in the ad?

For Ro, our partnership with Serena stems far beyond one commercial. It’s a larger, multi-year partnership, to share her incredible journey over time. From a pure cost perspective, we assigned a part of the deal to the production cost to keep ourselves intellectually honest.

Based on 10+ interviews with other brands who have advertised in the Big Game, talent for a Super Bowl ad ranges from $1-5M (of course there are outliers).

Accompanying ad-spend requirements

In addition to buying the ad itself, for every 30 seconds slot you purchase, you generally are required to commit to spending the equivalent amount on other programs broadcast by that network. So if you’re purchasing a $7-10M 30-second Super Bowl ad, you also need to spend another $7-10M on media on that same broadcast network (e.g., in conjunction with our Super Bowl buy, we’ll also have an advertising presence within the 2026 Winter Olympics on NBC ).

Total Cost

30-Second Ad (Media Cost): $7-10M

Production: $1-$4M

Talent: $1-$5M

Total Superbowl: $9-16M

Additional Media Spend: $7M

Total Committed Media + Production Spend: $16-23M

So now that we have the cost. How do we measure success? How do we measure ROI?

HOW DO YOU MEASURE SUCCESS?

The value of a brand to a customer can generally be distilled down to two parts 1) an association with a set of values (e.g., privacy, craftsmanship, the environment, status, wealth, etc.) and 2) the reduction in uncertainty (i.e., trust that the company will deliver on the promises it makes).

The value of a brand to a company must show up in some fashion in a company’s financials. Otherwise, the company’s brand does not have “value.” Brand awareness is not necessarily brand value (e.g., a lot of people know Enron). The way the economic value of a brand typically shows up is in one or a combination of the following:

Lower customer acquisition costs (i.e., CAC): through more efficient ad-spend or word of mouth.

Premium pricing power: if there are two identical products but people are willing to pay more for one because of the brand, that brand is driving additional LTV (i.e., lifetime value).

Loyalty/Retention: holding all else equal, if customers stay with a company longer because of its brand, that brand is driving additional LTV.

Again, one ad airing alone will not build a brand. One ad can’t make a great product on its own. However, that ad can make a promise that a product lives up to day after day, year after year, and decade after decade. That’s how great brands get built.

Of those three value drivers, the one that a Super Bowl commercial can mostly directly influence is Customer Acquisition Cost (CAC). It can do that by:

Driving sign-ups directly: Creating an ad that over 100M Americans watch, with some percentage of them then finding value in the product and going to sign up (7 day window)

Driving word-of-mouth: Creating word-of-mouth from the ad that increases the exposure of your brand/product and then more potential customers see it and purchase the product

Planting a seed: making yourself known to someone who may not be ready to purchase the product at that moment but could in the future. This is where the Super Bowl ad has the potential to make future advertising more efficient, even for those who don’t directly purchase the product within a narrow timeframe (i.e., within a week of seeing the ad). Think buying a car.

So how do we think about measuring the financial impact of the ad in the short and long term?

Short Term: it’s about tracking the conversion funnel — from beginning to end — across all touch points

Traffic Spike From The Ad Itself:

Immediate: one benefit of linear TV media is that impressions are concentrated, which makes measuring the immediate traffic lift of a large TV spot quite straightforward. We have an understanding of normal response rate ranges (the rate at which an impression translates to a site visit) from previous TV spots, and so we’ll know the strength of response and the immediate traffic spike within a few minutes of our TV spot airing.

Trailing: on top of the immediate spike, we are always refining our mathematical models on the ‘drag factor’ that we can apply to estimate the business impact beyond these first minutes and through the first week post-airing. We refine this understanding with secondary data points from surveys, statistical modeling, and holdout structures.

Complementing Ad:

Treating the Super Bowl spot as a standalone ad would leave value on the table. Instead, we constructed a multi-channel campaign where our marketing worked together to amplify the brand voice and drive resonance. This broader campaign includes:

Social: our ads reinforce the narrative from our Super Bowl ad to help engage and reengage patients who may be moving down from the top of our funnel into considering Ro

Search: we’ll ensure we own valuable search real estate so that potential patients can easily find Ro

CRM: we’ll communicate with patients who engage with Ro via our owned channels such as email, allowing us to go into greater depth around how Ro can support their health goals

OOH: potential patients will watch our ad on Sunday night and then be reminded of the campaign on their commutes the next week via out of home (OOH) ads in major US markets

TV: a batch of six complementary TV creatives will also launch immediately following Super Bowl Sunday. These ads are consistent with the “On Ro” creative direction of our Super Bowl spot as they share the powerful health journeys of real Ro members

The power of an ad with +100m reach is that its impact can trickle down to broader marketing efforts. The Super Bowl ad drives a leap in awareness that is an immediate catalyst for performance improvements across channels.

An example to drive this home → the value of a standalone OOH ad impression is X likelihood that this person will decide to sign up for Ro. We believe that likelihood is somewhere greater than X if that same person had also just watched Ro’s Super Bowl ad the evening prior

Overall Funnel: Zooming out, from the moment our Super Bowl ad airs through the rollout of complementary campaign elements, we will track the entire funnel from beginning to end. I’ll save people from the DTC metric diatribe — we track the traditional funnel metrics. This allows us to see the impact of the Super Bowl ad upfront and over time — holding as much constant as possible (of course there will always be confounding variables).

Long term:

Short-term performance tells you whether a Super Bowl ad worked in the moment. Long-term performance tells you whether it changed the trajectory of the business.

A Super Bowl ad is not designed to be evaluated solely on immediate attribution. Its real economic value shows up over time — through compounding effects that are harder to observe in the first week, but materially impact financial outcomes over months and years.

For the long term, we think about impact across both objective and subjective inputs — both tracked and analyzed in a quantitative way.

Objective:

We’re going to use the funnel input metrics and overall customer acquisition costs over the short and long term. In addition, over the long term, we’ll add market share as a key indicator. For market share specifically, we’ll rely on credit card data, insurance claims data, and other publicly available third-party sources (e.g., earnings reports).

Ro is the leading provider of branded GLP-1s in the country. Importantly, that leadership has been driven more by product performance than by brand awareness. In other words, our market share has outpaced our brand equity.

The Ro brand itself is only three years old. But the Ro Platform—the technology that powers everything from diagnosis to treatment delivery to ongoing care—is nearly nine years old. Over that time, we’ve demonstrated health outcomes that match clinical trials for both weight loss and safety as well as improvements in key biomarkers (read more here and here). By optimizing the end-to-end product experience first, we were able to capture market share before reaching full consumer awareness.

This dynamic—strong real-world performance paired with underdeveloped brand awareness—is rare. It’s also exactly the scenario where investing in brand can have an outsized return, which is one of the reasons we felt comfortable making our first Super Bowl investment.

Subjective:

In addition to analyzing first-party performance metrics and third-party data on market share, we use research measurement to attempt to quantify how the brand is (or isn’t) sticking in people’s minds. This research isn’t a replacement for behavioral or market outcomes. It’s a complement that can provide earlier signals on whether consumers remember Ro, recognize Ro, trust Ro, and associate Ro with the right message over time.

The primary tool we use here is brand tracking surveys. Brand tracking surveys are the foundation of our Research Measurement, providing the earliest and most direct read on shifts in consumer perception and memory.

Core Metrics: Aided and Unaided Brand Awareness

Our primary focus here is on aided and unaided awareness. These metrics are considered the leading indicators of campaign success - early evidence that Ro is becoming more salient with our target market. While survey metrics are imperfect by nature and subject to recall bias, they remain the best standardized tool for tracking longitudinal progress in brand mindshare.

Methodology and Robustness

We use different tools to maintain a continuous pulse on the market. We are consistently in the field every day of the year, surveying a random sample of respondents monthly. This sample is meticulously mapped back to the US census (within our target) to ensure demographic representativeness.

To ensure statistical stability and meaningful trend analysis, we analyze awareness based on a rolling 90-day window. This robust sample size within a 90-day period allows us to confidently examine not only overall awareness within our defined target market but also to perform deep dives into awareness shifts within specific demographic groups that matter most for our growth.

Secondary Metrics

To gain a richer, more diagnostic understanding of the campaign's mechanics, we also monitor secondary metrics. Most relevant to the Super Bowl are:

Brand Activity Recall: This helps us gauge how they are hearing about us—specifically, the association with a major initiative like the celebrity endorsement (e.g., Serena Williams) versus general product or performance campaigns.

Source of Awareness: This is critical for understanding where people are hearing about Ro (e.g., word of mouth, earned media, paid media, direct response channels).

The Math: What Needs to Be True for This to Work?

At this point, we’ve laid out:

Why the Super Bowl is a unique advertising moment

What the fully loaded cost looks like

How we think about measuring success in the short and long term

Now comes the real question: What actually needs to be true, numerically, for a Super Bowl ad to be a good decision? To answer that, we break the math into two parts:

Short-term impact: immediate customer acquisition

Long-term impact: improved efficiency of future marketing spend

Importantly, these are not mutually exclusive. In practice, they reinforce one another. But separating them makes the economics easier to reason about.

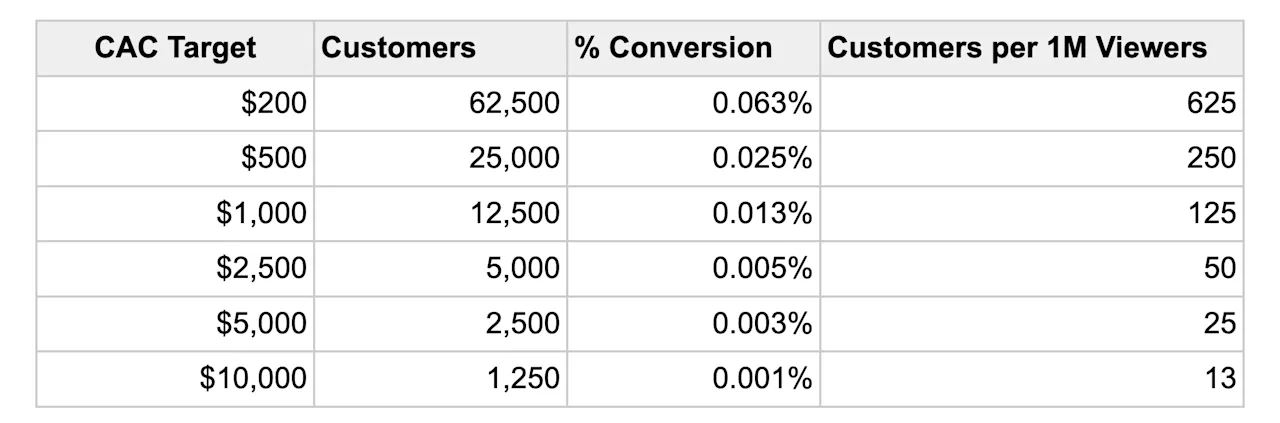

Short-Term Math: Immediate Customer Acquisition

To make the math concrete, we’ll start with a simplified assumption. Let’s assume a fully loaded cost of $10M for a 30-second Super Bowl ad. In reality, capturing demand immediately after the ad also requires incremental spend in other channels — search, social, CRM, and retargeting — to “catch” the interest the Super Bowl creates. To account for that, we’ll assume a total short-term cost of $12.5M.

Different companies define “efficiency” differently:

Some target an X-year payback (1,2,3,4,5 etc.)

Some are comfortable acquiring customers until marginal CAC equals terminal LTV

Rather than debate philosophy, we’ll anchor on CAC targets, since every company has one.

Below is a table showing how many incremental customers you’d need to acquire “directly” from the Super Bowl moment to hit various CAC targets.

Note: “Directly” is in quotes because many customers won’t type your URL immediately. They may search, click a paid ad, or convert days later — but those conversions are still economically downstream of the Super Bowl exposure. This is more relevant for products that are immediately searchable (someone is unlikely to buy life insurance or a car on their phone during the game).

Imagine you run a company that has a customer acquisition target of $X.

If your CAC target is $500, the ad would need to generate ~25,000 incremental customers — roughly 250 customers per million viewers — to pay for itself purely on short-term acquisition.

We don’t think most companies run a Super Bowl ad because they expect it to fully pay for itself this way. This table exists to make one point clear: the numbers required for short-term break-even are not absurdly large.

Long-Term Math: Efficiency Compounding

The more interesting math — and often the more important — happens over time. For the long-term analysis, we’ll look at a 12-month time horizon. This is likely conservative, but it provides a clean frame.

The question we’re asking is: What if the Super Bowl ad increases the efficiency of future marketing spend by a small amount?

Let’s imagine a company’s annual ad spend and estimate that the Super Bowl increases efficiency of that spend by 1%, 3%, 5%, and 10%. As discussed, it could do this in a variety of ways (e.g., decrease the cost of traffic through higher performing ads, increase word of mouth etc.).

Two things jump out immediately:

The larger the marketing budget, the smaller the efficiency gain required for the Super Bowl ad to pay for itself.

Very modest percentage improvements can translate into meaningful dollar impact.

For a company spending $500M annually on marketing, a 2% improvement sustained over a year effectively covers the full cost of a Super Bowl ad — without counting any short-term acquisition at all.

Combining the Short & Long Term:

In reality, the economics don’t operate in isolation.

Ads that drive strong short-term acquisition often also improve long-term efficiency

Long-term brand gains often show up first as improved short-term performance

When you combine the two, the bar for success gets meaningfully lower. For example:

A company with a $500M marketing budget

A $500 CAC target

Could view the Super Bowl ad as efficient with:

A ~1% improvement in marketing efficiency over 12 months, and

~12,500 incremental customers acquired in the short term

That’s roughly 125 customers per million viewers — well below the threshold required for short-term break-even alone. And again, a one-year horizon is conservative. Brand-driven efficiency often persists longer than twelve months.

Capped Downside, Very High Upside

When you put all of this together, the risk profile of a Super Bowl ad becomes much clearer. On the downside, the financial risk is meaningfully capped. Even in a scenario where the ad underperforms and only recovers roughly half of its cost, the impact on the overall marketing program is relatively modest. For most large advertisers, this would translate into approximately a 0.5% to 2.5% decrease in annual marketing efficiency, depending on the size of the company’s total marketing budget. In absolute terms, that downside might look like a $5–7 million loss over the course of a year — not insignificant, but also not existential for companies operating at this scale.

Ro has also battled tested advertising during NFL games over the last several years (pre-kick, in-game, post-kick, regular season, playoffs, championship games, Monday nights, Thursday nights etc.)

The upside, however, is far less bounded. If the ad succeeds in improving brand awareness, trust, and understanding in a way that meaningfully increases the efficiency of future marketing spend, those gains can compound quickly. Because the value scales with total marketing budget, even small percentage improvements can translate into tens of millions of dollars in incremental value. In stronger scenarios — where efficiency gains persist and reinforce future campaigns — the upside can reach $50 million, $75 million, or even $100 million or more over time.

This asymmetry is why we think about a Super Bowl ad not as a moonshot, but as a portfolio decision. The downside is known and capped. The upside is uncertain but potentially very large. When evaluated this way — and when paired with a product and story that can genuinely resonate at scale — the investment starts to look less like a gamble and more like a calculated bet with a highly favorable risk-reward profile.

SO…IS IT WORTH IT?

What makes the investment rational isn’t the hope that everything goes perfectly. It’s the structure of the bet itself. The downside is relatively capped, particularly for companies already spending hundreds of millions of dollars annually on marketing. Even meaningful underperformance typically results in a modest, one-year efficiency hit. The upside, on the other hand, is driven by compounding effects — increased brand awareness, improved trust, and higher-performing future advertising — which can scale dramatically over time.

When you look at the math this way, a Super Bowl ad is far closer to a calculated portfolio bet than a moonshot. The investment should not be judged on short-term attribution alone, nor should it be evaluated as a standalone channel. Its value comes from the combination of:

Immediate customer acquisition

Increased efficiency of future marketing spend

Longer-term brand gains (e.g., reduction in CAC, pricing power, retention)

When those effects are combined, the bar for success becomes far more achievable across a wide range of business models. And importantly, the larger a company’s overall marketing budget, the lower the relative risk of making the investment.

This is why, year after year, companies continue to buy Super Bowl ads — even as prices rise. Whenever businesses repeatedly allocate capital to something that looks expensive on the surface, there is usually sound math underneath it.

SO WHY DID RO DECIDE TO TAKE THE PLUNGE THIS YEAR?

When thinking about whether you take the plunge, you can drive yourself spreadsheet nuts before you write a $20M check (ad, production, accompanying ad spend etc.) for an extremely concentrated ad buy. You can analyze the numbers, model it out, and see that the math could math. A lot of growth & marketing is pure “money ball.” Rigor matters. Discipline matters. Moneyball matters.

But remember that the Oakland As never won a World Series title with money ball alone. The Dodgers, still running math, decided to pay up for the best and dominated. At the limit, people often miss the x-factor. They underestimate the tail end of the exponential curve.

Every enduring company eventually reaches moments like this—moments where the inputs finally line up. We felt it was the perfect time for Ro.

It’s Ro’s time.

We’re not testing an idea. We’re scaling something that has helped millions of people already. We have a product that is worth telling the world about. While the Ro brand is only a few years old, we’ve obsessed over making it as convenient as possible for patients to achieve their health goals for nearly a decade. A patient can go from diagnosis to delivery in less than 48 hours. They can see an ad for a GLP-1 on Sunday night during the Super Bowl; have a doctor review their medical information; and if their doctor determines that it is appropriate, get their meds prescribed and shipped, and take their first dose by Tuesday.

The GLP-1 market is highly underserved and the largest consumer health market of our lifetimes. The majority of people watching the Super Bowl will be eligible for our product.

A new form factor, the GLP-1 Wegovy pill, was just released in January at a starting dose of $149, down from a cash pay price of $1,300+ just 18 months ago.

Last but not least, we have Serena Williams, the GOAT 🐐, one of the greatest athletes to ever walk the face of the earth, sharing her journey…on Ro…and why it’s had a profound impact on her life. A story lived by millions of people. The opportunity to create a moment that gives people permission to seek out the best healthcare for them.

There will never be a spreadsheet cell that tells you it’s “time.” There’s just a moment when the math is good enough, the upside is asymmetric, and your gut—earned through years of building—says go.

Sometimes you just have to grip it and rip it. We felt it was worth the swing and, most importantly, we hope you enjoy the ad (and the game).

Disclosure: Williams’ husband is an investor in Ro and serves on its board.