Here's what we'll cover

Here's what we'll cover

Here's what we'll cover

When it comes to GLP1s and the adjacent drug classes (GLP1s+ for simplicity), I constantly remind myself that we have to hold two competing ideas simultaneously.

The present reality for patients is extremely challenging

Today is the worst it will ever be

Present Challenges

I won’t spend too much time here as not a day goes by where there isn’t an article, paper, or opinion piece on all of the challenges surrounding GLP1s. I’m not avoiding it to diminish its significance either — it’s important to talk about, write about, and research. We at Ro have done our own fair share and will continue to as well. Society must be aware of the reality that over 110M patients face today:

Medicare is legally prohibited from covering medication to treat obesity

Only 18 states cover anti-obesity medications under Medicaid (detailed analysis of Medicaid coverage from the STOP Obesity Alliance & OAC).

50% or less of commercial plans cover GLP1s for obesity, and those that do often have unreasonable hurdles

“Covered” can still mean $500-1000 out of pocket every month.

Doses listed as “Available” on the FDA’s shortage list are backordered at pharmacies across the country

Obesity rates are expected to exceed 50% in the majority of states by 2030

Patients with obesity have, on average, ~$2000 higher healthcare costs per year

Obesity is associated with 8 out the 10 leading causes of death and 200 health complications

There is a nationwide shortage of healthcare providers, with the problem only expected to worsen (50% are older than 55 years old)

There is intense stigma associated with obesity and treatment for the condition in the media, healthcare, socially and professionally

Access is unequal. Supply is hard to come by. And our healthcare system is already capacity constrained as obesity rates continue to climb. If I had my way, we’d be full steam ahead on an operation warp speed for GLP1s, similar to what Dr. Robert Pearl described here, as these drugs have the opportunity to be the single most effective intervention in increasing health equity across the country. But, that’s for another blog post.

Today, I want to zoom out and reframe the discussion. We can often get lost in the problems of today and forget both how far we’ve come and how exciting the future will be.

“Most people overestimate what they can do in one year and underestimate what they can do in ten years.” (Bill Gates)

From the drugs themselves to insurance coverage to the cost to supply, it will only get better from here. Let’s break it down.

GLP1s+ Are The Least Effective They Will Ever Be

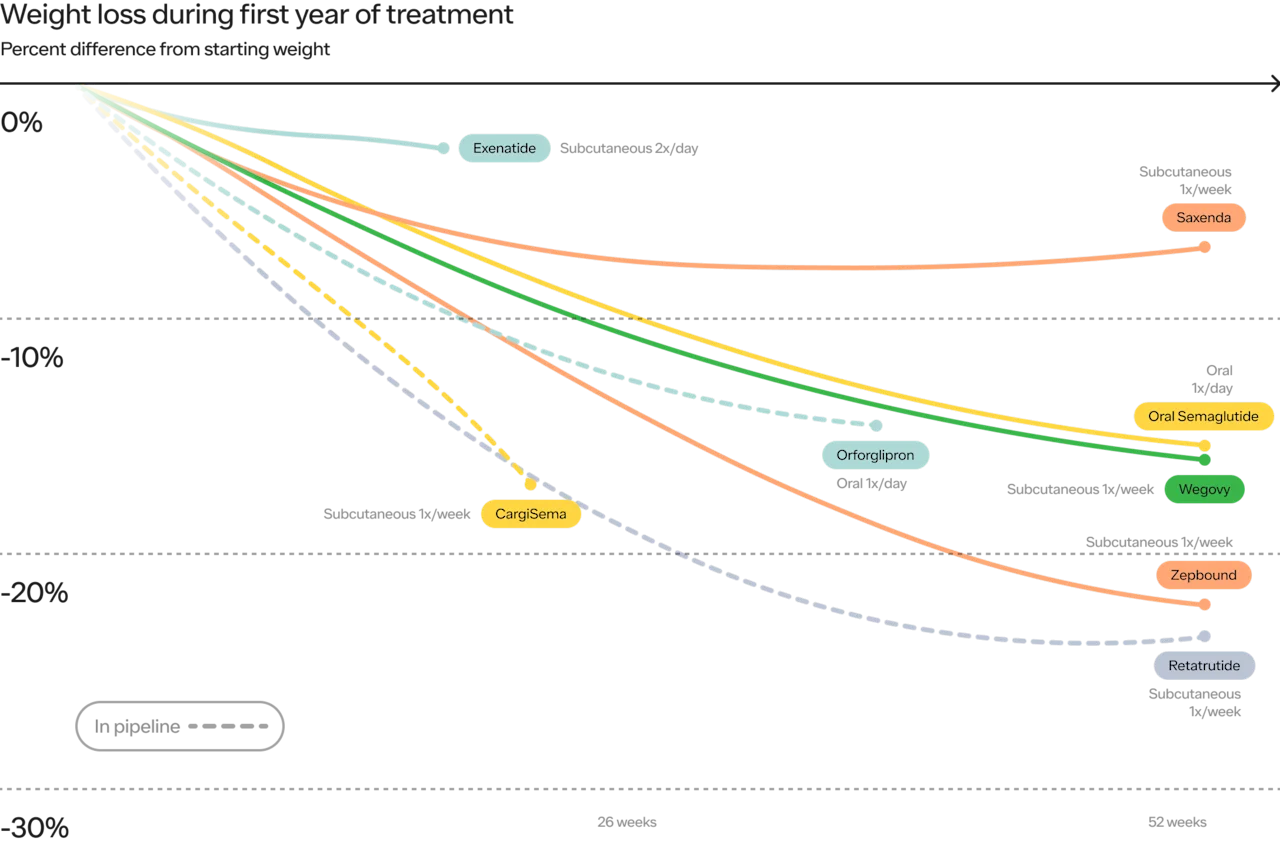

Take a look at this chart below. On the X axis, we have time. On the Y axis we have efficacy (measured by percentage weight loss). Both have come so far and are still just getting started.

The initial GLP1s showed 3-5% weight loss. Today, Wegovy and Zepbound show 15% and 22%, respectively. Looking at the not too distant future, we see 25% or more, over shorter periods of time, with the weight loss curve in studies not quite asymptotic (meaning the ultimate weight loss results could be even stronger).

From a weight loss and maintenance perspective, this is just the beginning.

Expanded Indications

GLP1s were originally approved for Diabetes in 2005. Since then, they have been approved for:

Obesity / chronic weight management

Cardiovascular disease in patients with Obesity (SELECT Trial)

And have shown phenomenal results for Chronic Kidney Disease (FLOW Trial) and Sleep Apnea (SURMOUNT-OSA Trial)).

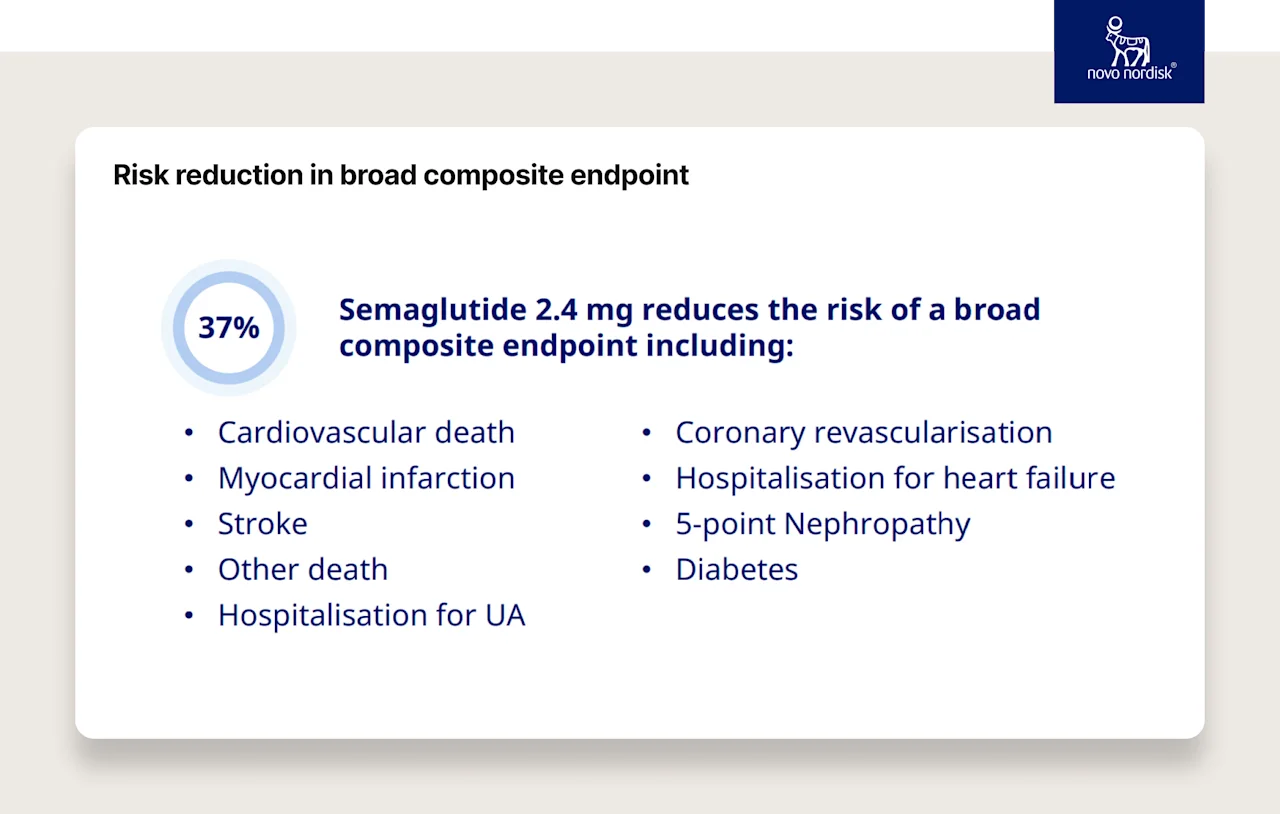

SELECT Trial — Cardiovascular Disease

20% reduction in the risk of cardiovascular events

37% risk reduction in a broader set of secondary outcomes (including cardiovascular death and stroke)

FLOW Trial Chronic Kidney Disease:

Novo Nordisk’s clinical trial, which enrolled 3,533 people with type 2 diabetes and CKD, was ended early as a result of clear efficacy.

People treated with semaglutide saw a statistically significant 24% reduction in the progression of kidney disease and death from kidney and cardiovascular causes versus the placebo group. And, the treatment group saw a 20% lower risk of death of any cause than those who received the placebo.

SYNERGY-NASH trial, Metabolic dysfunction-associated steatohepatitis (MASH):

Tirzepatide was more effective than placebo with respect to resolution of MASH (formerly Non-Alcoholic Steatohepatitis or “NASH”, sometimes known “Fatty Liver Disease”) in patients with significant disease (stage 2 or 3 fibrosis).

Results showed resolution of MASH without worsening of fibrosis occurred in 43.6%, 55.5%, and 62.4% vs 9.8% in the placebo group. Additionally, 59.1%, 53.3% and 54.2% of patients taking 5 mg, 10 mg, or 15 mg tirzepatide respectively achieved a 1-stage or greater fibrosis improvement without worsening of MASH versus 32.8% of patients on placebo.

SURMOUNT-OSA Trial Sleep Apnea:

Tirzepatide meaningfully improved sleep apnea symptoms in those with obesity and moderate-to-severe obstructive sleep apnea (OSA) – including for those who were and were not on positive airway pressure (PAP) therapy.

In SURMOUNT-OSA 1, which included patients who were not using PAP therapy, 43% of participants on the highest dose met the criteria for disease resolution. In SURMOUNT-OSA 2, which included patients who were using PAP therapy, 51.5% reached disease resolution.

Results showed a mean apnea-hypopnea index (AHI) reduction of up to 63% (about 30 fewer events per hour). AHI records the number of times a person's breathing shows a restricted or complete block of airflow per hour of sleep and is used to evaluate the severity of OSA.

Studies are also underway to assess the efficacy of GLP1s for:

Addiction: Semaglutide and Tirzepatide reduce alcohol consumption in individuals with obesity (Scientific Reports, Nature), Semaglutide for Alcohol Use Disorder (Phase II clinical trial by UNC)

Alzheimer's: The mechanism and efficacy of GLP-1 receptor agonists in the treatment of Alzheimer’s disease (Frontiers in Endocrinology)

Mental Health & Suicidal Ideation: Most GLP-1 Medications Correlated with a Lower Likelihood of Anxiety and Depression Diagnoses (Epic Research)

Alcohol-related liver disease (Novo Nordisk clinical trial)

Osteoarthritis (STEP 9)

Metabolic dysfunction-associated steatohepatitis (MASH): Tirzepatide for Metabolic Dysfunction–Associated Steatohepatitis with Liver Fibrosis

This is just the beginning. For example, because muscle loss is a concern for some patients on GLP1s+, we’re seeing further pharma investment in research evaluating how muscle maintenance and muscle generation works. This research will benefit not only people on GLP1s, but also people not on GLP1s+ in the future. The pharma industry would not be investing as much money in muscle maintenance if they didn’t see the adoption of GLP1s+ (ripple effect). This is just one example of the fascinating cascading benefits of GLP1s+ in terms of treatment expansion.

Useability — Form Factor and Frequency

Frequency

When GLP1s first launched, not only were the weight loss effects modest (e.g., 3-5%) but they often required daily (or even twice a day) injections. That was in the early 2000s. Today, it’s once a week. When we look ahead, companies like Amgen are showing promising early results with once-a-month injections (emphasis on it’s early)! Novo and others are also studying “vaccine-esque” treatments that would require only once-a-year injections.

Medicine and science are incredible, and there are examples of permanent cures of other diseases with treatments that last ~3 years and then are no longer needed (e.g., osteoporosis) — who says that we can’t get there with obesity as well?

Note on permanent cures:

There are questions around the “holy grail of obesity treatment” that would permanently reset a patient's set point to a lower level. There are experts who have debated the pros and cons of being able to permanently rewire an individual’s metabolic processes, as there are benefits to our bodies’ ability to adapt to different needs and contexts (e.g., pregnancy). The changing of the set point is an evolutionary response in the first place that allowed us to survive and thrive up to this point (even though the current mechanisms may be less important for our current environment).

Form Factors

Some of the criticisms around the accessibility of GLP1s+ have focused on patient reluctance to take injectable medications and the scalability limits of injectables that require both auto-injector pens and cold chain shipping. In this section, I’ll focus on patient adoption, and later in the post, I'll delve into supply forecasts and expansion.

Injectable format has not been a deterrent from a patient’s perspective thus far

While many patients are initially hesitant, Ro hasn’t seen the self-injection form factor as a rate-limiting factor on patient demand for treatment as of right now (there are supply shortages because of such significant demand).

Why?

Obesity is a far greater pain point in people’s lives than people realize

The medications are incredibly effective

The injections aren’t as bad as people think

The injections can actually reduce the overall medication admin burden

I just watched my wife go through egg freezing, and she took multiple shots daily, in a highly complicated way, in the span of 14 days. People are willing to go through great lengths to live the life they deserve.

This is one of the reasons Novo Nordisk and Eli Lilly have spent a significant amount of time on these innovative auto-injectors. There are pros and cons to this approach (more on the supply situation down below), but they do make taking the medication rather seamless from the patient’s perspective. We cannot underestimate the impact of friction reduction on the efficacy and persistence of a treatment regimen.

One of our advisors, Dr. Beverly Tchang, gave a fireside chat to our team a few weeks ago and emphasized that the healthcare system often puts the burden on the patient — even in the language we use when we describe a patient as “non-compliant”. We must see “non-compliance” as a challenge that we as the healthcare system take on by inventing new protocols, drugs, and processes that reduce the burden on the patient — that is one of the best and fastest ways to increase “compliance.”

GLP1s+ are a perfect example of this. You’ll see some patients on 3-4 different medications, who require glucose checks and insulin injections multiple times a day, switch over to GLP1s and go from needing 30+ doses a week of different medications to 1 per week with Wegovy/Ozempic or Zepbound/Mounjaro. Yes, this person is taking an injection once a week, but they are no longer pricking their finger four times a day and taking medication three to four times a day (and working around meals etc.).

It’s why I highlighted the frequency reduction in the GLP1s+ regimen above. Pharma’s relentless push to go from 2x/day (730/year) to 1x/week (52/year) and eventually to monthly and yearly — can dramatically reduce the overall burden of managing a chronic disease for patients, significantly increasing persistence and therefore efficacy of the treatment and ultimately, healthspan and lifespan. It’s not just the weight loss results in the trials (e.g., 5% to 22%) but the way in which it is achieved (i.e., a better patient experience). That’s absolutely incredible progress over the last 10-15 years!

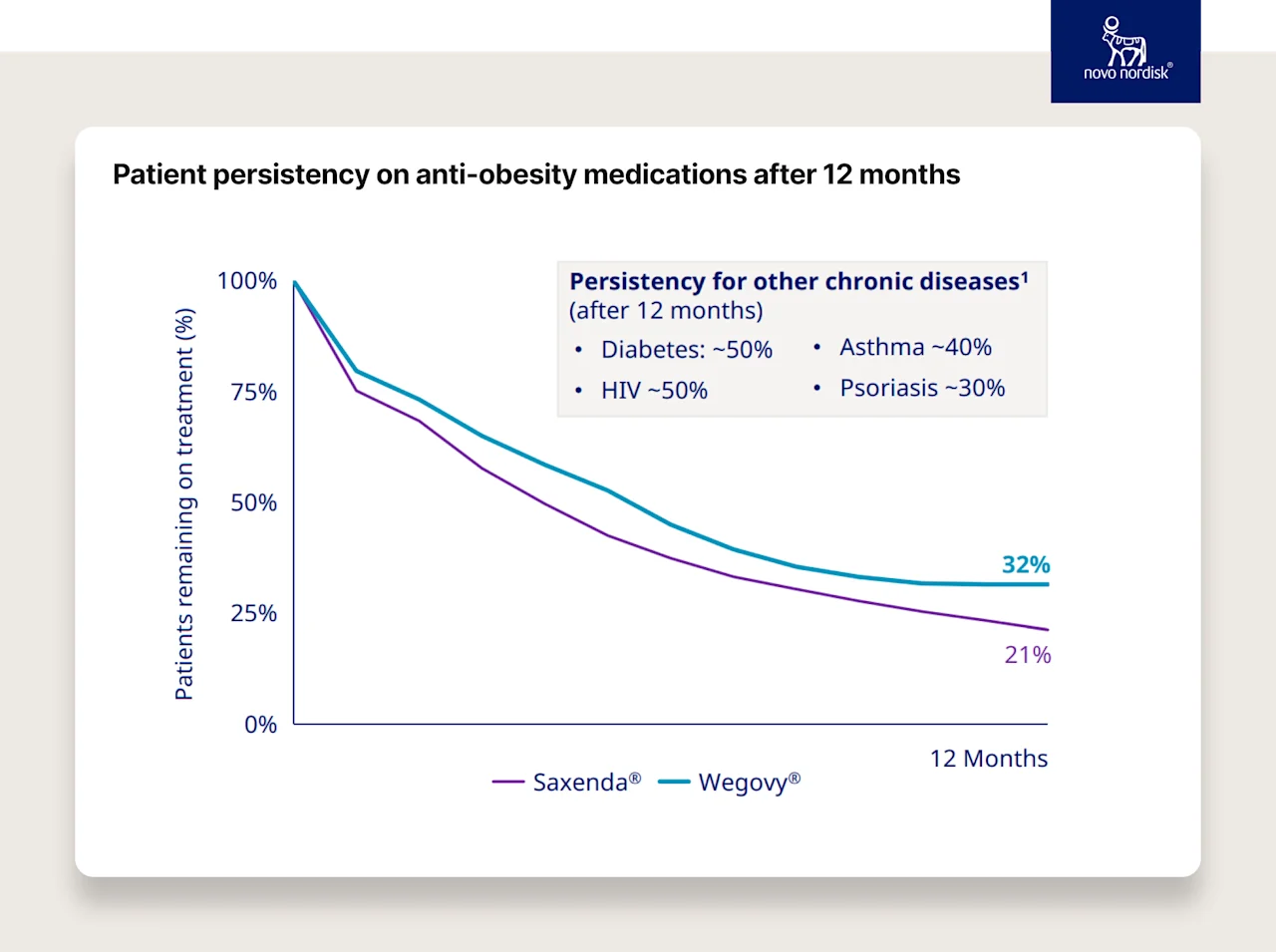

Look at the impact of both increasing efficacy and reducing the frequency of dosing for the patient on persistence. The chart below shows Saxenda (7-9% weight loss, injected daily)) compared to Wegovy (~15% weight loss, injected weekly).

Now imagine this effect on tens (if not hundreds) of millions of people as these drugs get more effective, the clinical indications expand, and treatment regimens become less frequent.

Seeing this progress, how can you not be optimistic about our future?

Orals

These injectables are extremely effective, and 1x per week does seem to be an improvement. But there are limitations. From fear of needles to cold chain shipping to the scaling of these fill-and-finish auto-injector pens (again, more below), there are limitations.

One of the things the pharmaceutical industry has done extremely well over the last 50 years is scale oral tablets. Contrary to popular belief, generic medication in the US is extremely cheap and often less expensive than in other developed countries. You can walk into any Walmart (90% of the US population lives within 10 miles of a Walmart) and buy the most common generic drugs for $4. If you’re an Amazon Prime member (~50% of the US population), you can get most of your generic drug needs for $5/month (not $5/drug… $5/month for ~60 drugs, whether you’re on one or five). Again, we have a lot to fix in our healthcare system. I read about it and witness it every single day. But we also have some wins that are worth putting on the board and emphasizing. Again, it only gets better from here.

The biggest challenge historically with oral GLP1s+ has been both getting sufficient bioavailability and increasing the half life of the drug when it goes through the digestive tract. Our bodies chew up the GLP1 tablets quickly, so we don’t absorb as much and they don’t last very long. This is why the subcutaneous GLP1s+ injections have been so much more effective than orals (e.g., Zepbound at 22% weight loss v.s. Rybelsus at 3-5%) — they skip the GI tract. Injectables will likely be more effective than orals for the foreseeable future (as noted above, we have more effective injectables on the horizon) but that doesn’t mean orals won’t be great options for tens of millions of people.

Orals can be another great option for a set of patients. Many patients:

Don’t need to lose 25-30% of their body weight

Don’t want to take an injection or simply prefer an oral tablet

Don’t live in an area where cold-chain injectables are easy to manage

May be able to maintain their weight after an injection-based therapy with orals

There are oral GLP1s+ showing great potential in current studies:

Lilly’s Orforglipron: ~15% weight loss (similar to Wegovy), not impacted by meals, etc.

Novo’s higher dose oral Semaglutide: ~15% weight loss but there are concerns around its side effect profile relative to injectables (and therefore persistence)

Even more in the pipeline: Pfizer, Structure Therapeutics, Sciwind Biosiences, AstraZeneca

Two quick notes on orals:

Because of the way oral GLP1s are digested, they need far more API (active pharmaceutical ingredient) to make them. For example, the OASIS Trial is studying 25mg and 50mg daily semaglutide for weight loss. If a patient is on the highest dose (e.g., 50mg per day), that’s 350mg of semaglutide per week compared to the highest dose of an injectable (2.4mg per week). That means the weekly oral form factor requires more than 145 times the amount of API. That requires significant manufacturing capacity, and API manufacturing capacity usually takes about ~5 years to increase.

GLP1s+ are more complex to produce than typical small molecule oral tablets. Because of the way they are digested, there is significant technology required to slow down the process of absorption to increase bioavailability and extend the half life of the drug. We’ve solved this problem for other drugs with extended release, but I want to highlight that it's not simply copy and paste here (it will take innovation and time).

GLP1s+ Summary

In the last 30 years, we’ve gone from no GLP1s+ or truly scalable weight loss treatments to having treatments that:

Efficacy: help patients lose 22% (and still rising) of their weight on average, up from 3-5%

Disease Expansion: are approved for diabetes, obesity, cardiovascular disease and soon likely kidney disease and sleep apnea, with more conditions under study

Frequency: are taken 1x/week, down from 2x/day (52 times per year versus 730)

Form Factor: can be taken orally with more effective options on the horizon

Improving the form factor, reducing the burden placed on the patient, all while maintaining and increasing efficacy across weight loss and other cardiometabolic measures, these are incredible feats of science that will benefit humanity in ways we cannot yet comprehend, especially once prices decline. That is worth appreciating and, for me, worth marveling.

Obesity was often overlooked at many pharmaceutical companies, and it took investing billions of dollars in the face of significant criticism to get us here. Again, I know the current situation can look bleak, but when we zoom out, we’ve come quite far, and there is so much to be excited about for patients.

Insurance Coverage

We have these revolutionary new treatments that some are calling “miracle drugs,” but access is limited.

Medicare covers GLP1s+ only to treat patients with diabetes or patients with obesity if they have diagnosed cardiovascular disease

Only 18 states cover anti-obesity medications for Medicaid patients

Less than 50% of commercial plans cover GLP1s for obesity, and those that do often impose unreasonable hurdles on coverage

Cash pay prices are $1000-$1500/month (without savings cards)

Cash pay with savings card is at least $550 for Zepbound and $650 for Wegovy

I’ve written about the lack of coverage here. “Every day we don’t solve for the cost and coverage of these drugs, we risk the greatest acceleration of health inequity of our lifetime–creating an even greater gap in health equity that I believe will have a profound and durable impact on our society that will be increasingly difficult to reverse. At the same time, I believe GLP1s (and adjacent drugs) also present the greatest opportunity to bridge the gap and dramatically decrease health inequity in this country.”

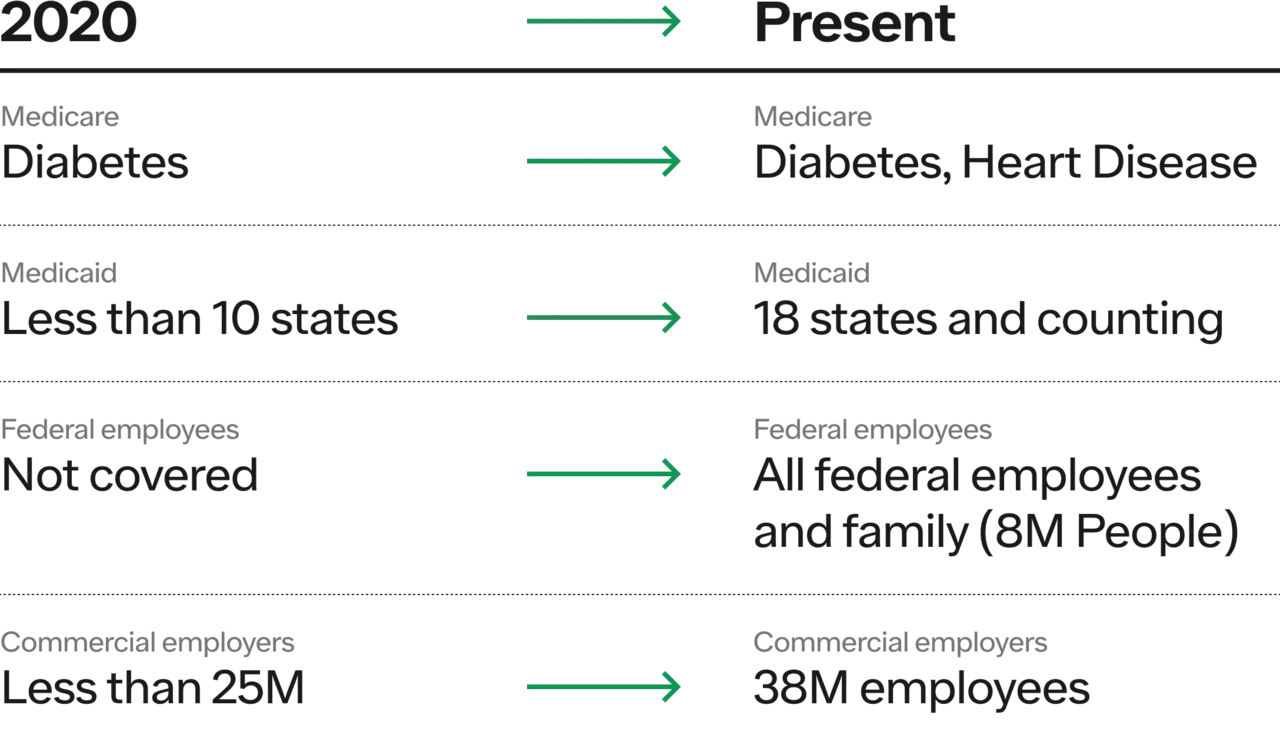

Putting my optimistic hat on, I want to call out the awesome progress that “we” (patients, regulators, patient advocates, employers, providers, health systems, government) have made over the last few years. Again, there is always more work to do, but this post is about taking a moment, zooming out, and realizing that while today might have challenges, today is better than yesterday and, given the directional arrows of progress, tomorrow should be even better.

Over 50M Americans had coverage for Wegovy in 2023. For commercial plans, 10.5M additional people received coverage while only 0.5M lost their coverage. While we believe no plans should drop GLP1+ coverage, that is a pretty encouraging ratio (more than 20x the number of people gained coverage compared to the people who lost it).

Insurance coverage today is better than it was a few years ago, and all signs point to it being better a few years from now. Progress takes time (often too much time), but it is happening!

What will lead to coverage?

Label expansion: as the label for these GLP1s+ expand, it will naturally extend to already covered disease states (e.g., cardiovascular disease (CVD) for Medicare). This is why the studies for CVD, chronic kidney disease (CKD), and obstructive sleep apnea (OSA) were so significant. Coverage already exists for these, and label expansion increases the “return” in the ROI equation for both drug manufacturers and health plans.

Price reduction: with more competition and potentially generic options, and less expensive oral form factors, the price will hopefully decrease, which will make coverage more palatable and the ROI more clear.

Patient/Employee advocacy: we’ve seen strong evidence that ~40-50% of people will either stay at a job they hate, or quit and join another company based on GLP1+ coverage. It’s why you didn’t see many employers stop coverage even as costs increased. Similar grassroots movements have been effective for mental health and fertility benefits from an employee advocacy perspective, and forward-looking companies have used it as either recruitment or retention tools.

Government action: if the government covers GLP1s+ for obesity (without any comorbidities), many commercial plans will likely follow as Medicare is usually out in front here.

Cost

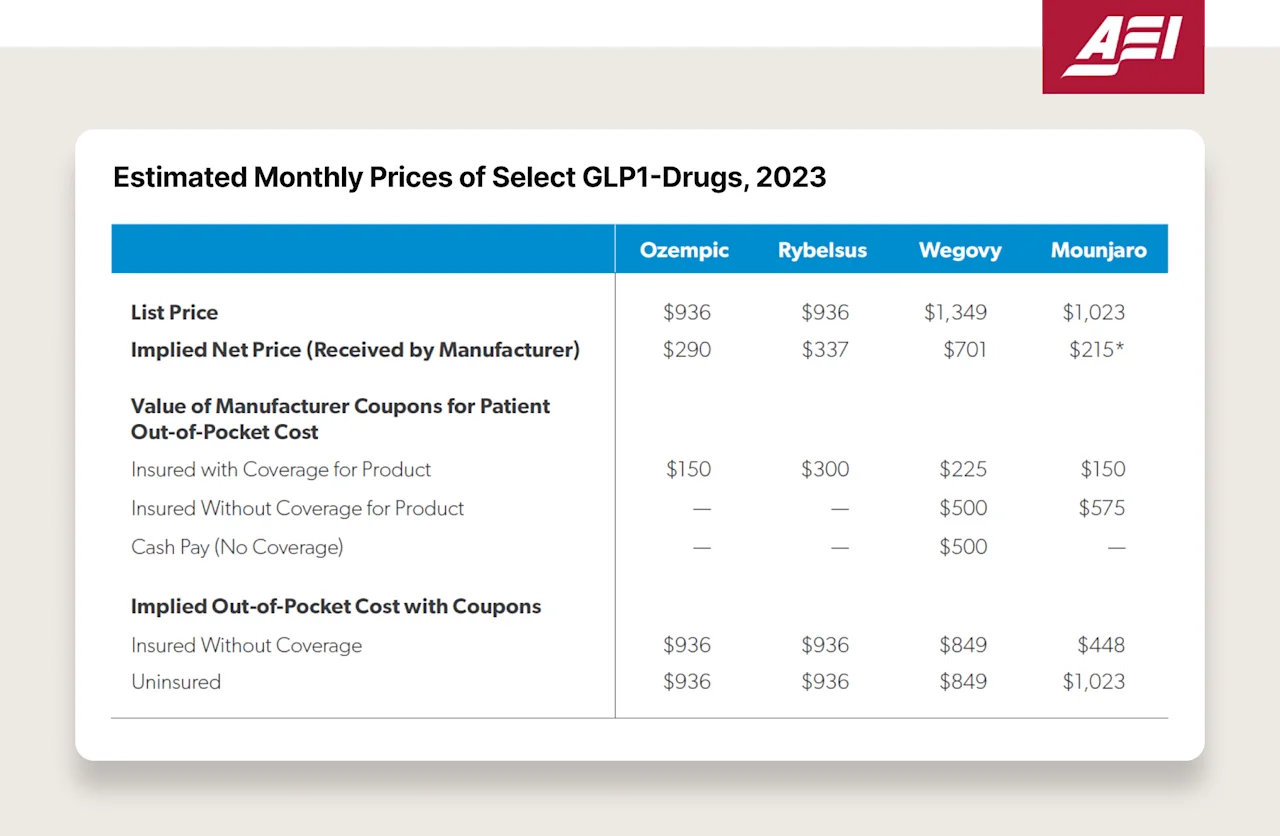

Saying the cost of GLP1s+ is too high right now is an understatement. The monthly prices of these drugs are (looking at list price and GoodRx):

Saxenda: ~$1,300

Ozempic: ~$1,000

Wegovy: ~$1,350

Mounjaro: ~$1,050

Zepbound: ~$1,050

Now, without going into too deep of a rabbit hole here, the only people paying these high list prices are patients who are not covered by insurance (the irony is sad and painful to see). Insurance companies are probably paying ~$3-5K/year (after deductible usage) for these medications, and pharma is receiving anywhere from 40-70% of the list. See this chart below — Novo is receiving $290 per Ozempic script, whereas the list price is ~$1,000. Where does the other $700 come from and go? It comes from patient’s pockets (via suppressed wages and increased healthcare premiums through employer coverage), and it goes to payors and PBMs (which are often owned by the same company — 79% of PBM transactions are owned by the largest three payers).

So what forces will drive down the price? Why am I still optimistic?

Competition:

Lilly entered the market in late 2023 with Zepbound. It results in ~40% more weight loss than Wegovy, and the list price is 20% cheaper! They launched a better product at a lower price. They also launched a savings card for those with no coverage or limited coverage where some patients pay $550/month — still expensive but ~60% cheaper than $1,349! It has led them to exceed 50% market share of new scripts in just five months since launch (April 2024; compared to Wegovy that has been out since 2021). The market is responding.

Novo just announced on their Q1 2024 earnings call that they’ve decreased the net (payer negotiated) price of Wegovy to increase formulary adoption (link). Even with two players and a supply shortage, we’re seeing competition at work to be at the top of the formulary, at the top of providers’ minds, at the top of patients’ minds. The size of the prize is the largest there has ever been in pharma, and the competition is just beginning.

Fortunately, we’re starting to see price-based competition manifest itself already, even though both companies will sell every pen they can make for the foreseeable future. They are acting already for the day that won’t be the case, and patients will benefit as a result.

Last but not least, there are 118 GLP1s+ in Phase 1 to Phase 3 clinical trials. More competition is coming.

Patent Expiration:

The patent for liraglutide expires soon, which should unlock generic competition. Yes, liraglutide is less effective, but a GLP1 is often better than no GLP1.

Ozempic came out in 2017, and the semaglutide patent is set to expire ~2030. I know that’s not tomorrow but ~5 years from now is not too far away.

Government action:

There are things the government has done and can do to continue to put pricing pressure on these revolutionary new drugs:

IRA: Ozempic will be eligible for IRA negotiations as soon as 2025 (pricing could go into effect in 2027) 2027, which should help reduce the price (link).

Medicare Coverage: As discussed above, the broader the label gets, the more coverage for GLP1s that will exist. In addition, if Medicare decides to cover it for patients with obesity, without requiring an additional comorbidity or diabetes, it will likely force commercial plans to follow.

Radical change: It’s well known that the US funds the world's drug innovation. We’re 6% of the globe’s population and often ~50% of pharmaceutical companies’ revenue. However, it seems entirely untenable that we fund innovation, pay ~10X the price (Ozempic is ~$120 in Denmark), and have a supply shortage when other countries do not. There are no supply shortages in Denmark, Norway, or Iceland. It’s mostly cash pay and has penetrated about 7-9% of their populations. To remedy this unfairness, the US could take a radical approach and say, if you, a pharmaceutical company, wish to sell your drug in the US, then if there is a supply shortage in the US, you cannot sell the drug abroad for a price below the price charged in the US. With such a policy in place, it's clear there would not be a shortage in the US for very long. If there were, it would be because the US was the only country in the world where the drug could be purchased, and demand still exceeded the supply. This radical policy would be fair when the US is paying 10x the price of everyone else (the US should at least get an advantage for paying so much and funding innovation).

Supply

It’s pretty hard to get a full read on the present and future supply situation of GLP1s+ across Novo and Lilly. Neither company has given extremely granular guidance. There are proxies I can walk through that are encouraging and give me hope but, ultimately, I would take them as directional.

A few high level bullets:

Both Novo and Lilly have estimated that they will invest $50B in CAPEX combined from 2022-2028.

Catalent, the company that is providing “fill and finish” for the GLP1 auto-injectors, has given guidance that revenue will increase 6x from 2023 to 2026 and then 2x from 2026-2030.

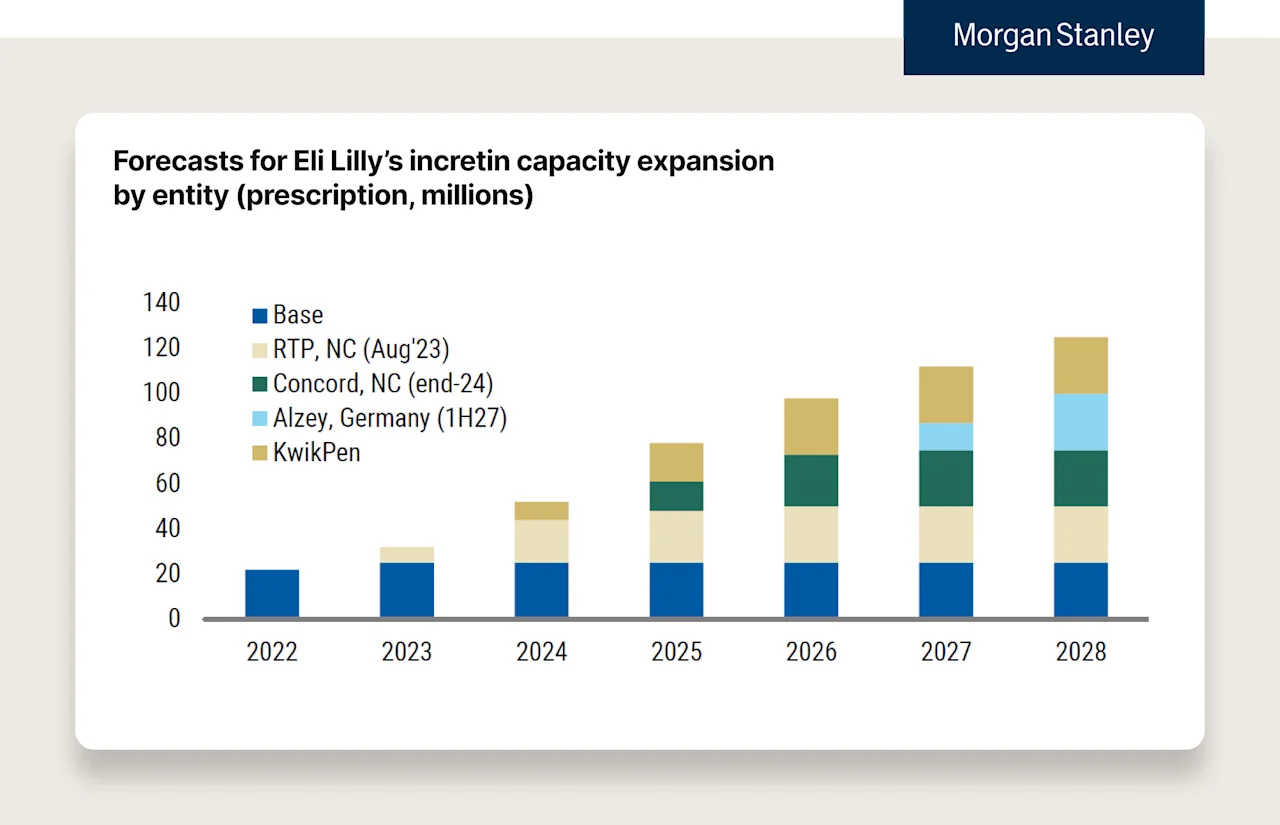

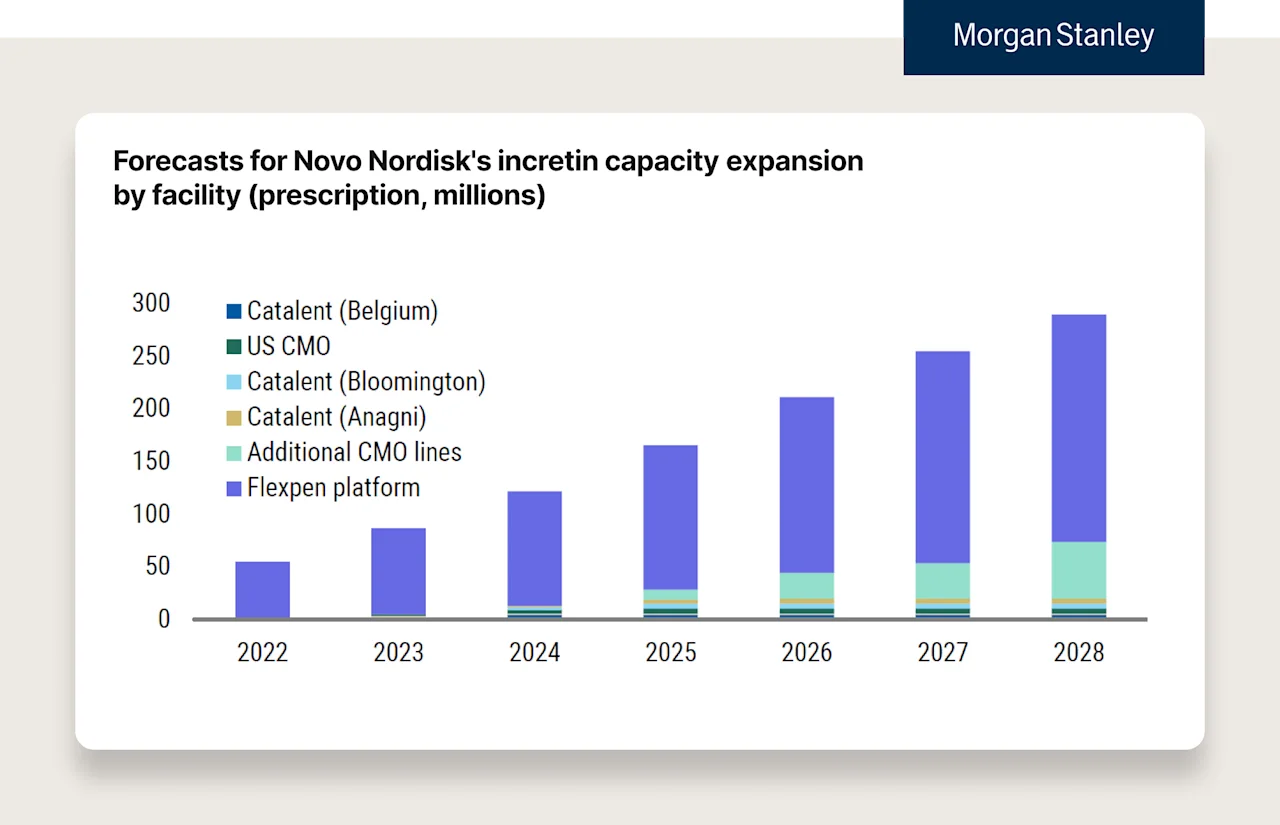

Morgan Stanley estimates that Lilly will increase auto-injector capacity by 4x from 2022 to 2027, and Novo will have a 5x increase in global capacity from 2023-2030.

Here are two Morgan Stanley charts estimating Novo and Lilly’s capacity respectively.

We can see supply really start to step up over the coming years with new manufacturing facilities and the leveraging of different devices (e.g., Kwikpen etc.) to expand capacity. A few quick notes:

Fill and finish facilities usually take about ~3 years to come online

API capacity facilities usually take about ~5 years to come online

Already approved devices (e.g., Kwikpen, needle & vial as opposed to the auto-injector) could unlock even more supply.

Note: Europe might benefit here before the US because the US incentivizes pharma companies to “update devices with novel solutions'' to extend patent protection (e.g., Epi-pen). Because many pharma companies delay releasing these innovations until right before the patent cliff ends (to have the longest possible coverage from patent to patent), we tend to see these innovations later. There is pushback here by regulators, but this is unlikely to change in the near future.

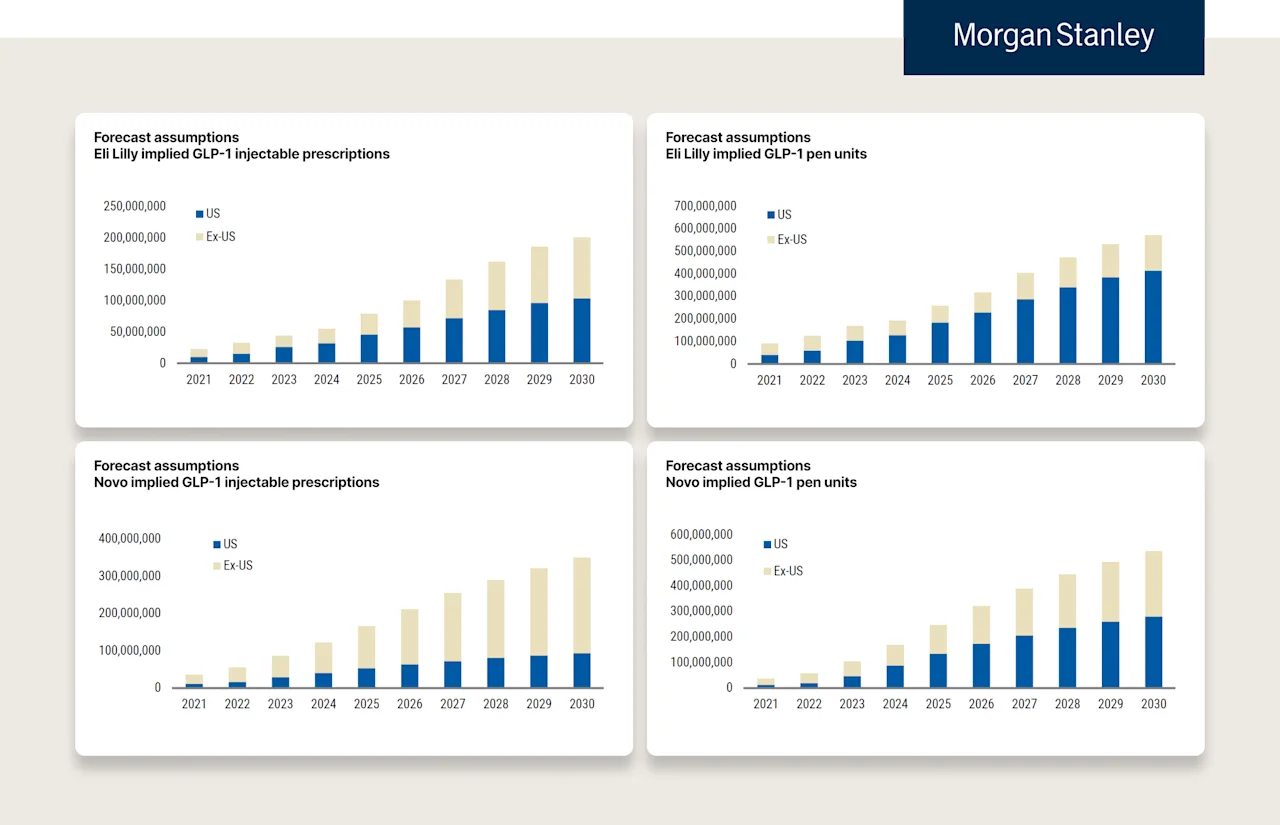

Here are four more charts from Morgan Stanley comparing Novo & Lilly’s “Prescriptions” and “Units.”

Notes on these charts:

Morgan Stanley estimates that Novo has about 4 “fill & finish lines” running in the US right now for Wegovy. Each line generates about 20M pens per year, ~80M auto-injectors total. When you read 80M pens or “units,” note that there are 4 pens in each prescription received by a patient. So 80M pens means capacity for 20M prescriptions annualized. [Math = 20M/13 (52 weeks, 4 pens per weekly prescription) = 1.53M — “1 years supply” of Wegovy].

So there is currently enough for 1.6M patients to be on Wegovy for an entire year. You can see why there is a shortage in the US (180M eligible, 110M have obesity, 50M have coverage, majority of covered pay less than $100, and there is only enough for 1.6M people not including churn). Important to note this excludes the estimates of Ozempic (estimates are that ~4-5M patients are on Ozempic in the US).

While Novo can produce ~80M Wegovy auto-injectors in the US right now, there are estimates that it’s on its way to producing ~250M in the US (and ~250-300M outside of the US) by 2030. Estimates for Lilly show a similar increase while the location of manufacturing differs (Lilly has far more in the US).

The supply challenge is one of those where I’m personally counting on human ingenuity, regulation, and competition. While making ~1B auto-injector pens per year is incredibly impressive for two companies, that’s probably enough for 25-30M people in the year 2030.

But, humans are terrible at exponential curves — as you’ll notice with most analyst reports — the growth curve is usually linear, whether it’s AI adoption, Nvidia’s revenue estimates (until now), or GLP1 manufacturing. But, we have a knack for fixing constraints, especially when there is one of the largest economic incentives ever discovered in healthcare. If we’re estimating 5-10x fold increases in supply over the next 7-10 years, I’m hopeful these estimates are wrong. Covid vaccinations are prima facie evidence that when a problem is big enough, and we’re aligned on solving it, things that take years can take months.

Quick note on supply and barriers to entry:

The more complex scaling of supply, the more resources it requires to build out manufacturing capabilities, the harder it will be for new entrants to compete, even with better drugs or improved form factors (e.g., Amgen’s 1x/month treatment) if they can’t keep up with supply.

Today is the Worst GLP1s+ Will Ever Be

GLP1s+

More effective (5% to 22% weight loss and on their way to 25%+)

More expansive disease management (diabetes, obesity, CVD, CKD, OSA, and studied for more)

Less frequent (2x per day to 1x week and on their way to 1x/month to 1x/year?)

Additional effective options in orals are on their way

Insurance Coverage

Medicare adding coverage for CVD (hopefully more diseases on the way as labels expand)

Medicaid added 5 states in just 2023

Federal government added all employees and family members in 2023

Commercial employer coverage increased by 35% in 2023, with more employers considering it

The Treat and Reduce Obesity Act (TROA) has been introduced in Congress to encourage Medicare coverage

Costs

Zepbound, a more effective drug, launched ~20-30% cheaper than Wegovy, with a savings card that put it at just over 1/3rd of the price at the time!

Novo announced Wegovy lowering price on Q1 earnings call to increase formulary adoption (competition doing its thing) and recently added a savings card program bringing the cash pay price down to $650/month

Saxenda’s patent expires soon! (TBD when generics are available given patent shenanigans)

More GLP1s+ on the way => more competition => lower prices

Government is paying attention, poking and prodding

Supply

Lilly + Novo investing 50B in Capex from 2022 to 2028

Catalent, large pen maker, has guided a 6x increase in revenue from 2023 to 2026

Morgan Stanley is estimating Lilly to increase its global GLP-1+ auto-injector capacity over 4x from 2022 to 2027

Yes, there is so much work to be done. We must keep innovating and fighting for patients as an industry — from inventing new treatments to using technology to scale access to high quality care to increasing coverage (across commercial and public payers).

While it’s not time for celebration, it is time for appreciation. Today is the worst it will ever be — from the drugs themselves to insurance coverage to cost to supply. When statins first launched they were ~$8000/year (not too far off GLP1s). Now, a cappuccino is more expensive than a month’s supply of generic Crestor.

You can add a “but” to anything I’ve shared above.

But…orals are hard to make and require 145x the API

But…TROA has been on the floor for a decade

But…ROI isn’t there for coverage yet

To which I say, yes … BUT.

You’re looking at the world as a static picture instead of the constantly improving, ever evolving, movie that it is. Look back, study the history of human progress, and imagine we press fast forward from here. Obesity itself is a product of progress. It’s a product of our solving famine in most parts of the world. That’s a good thing. But, we’re faced with another problem in obesity and more broadly various chronic diseases as a result. But guess what, we’re going to solve these, too. That’s what makes humans incredible. We have the potential and desire to make the world around us better for all of us. We’re not always successful, and we do make mistakes, but zoom out far enough, and we’re doing a remarkably good job (I’m writing, you’re reading this, and we’re not in a cave).

For obesity, you don’t even have to zoom out that far. The problem simply didn’t exist at a national or global level 100 years ago. Fifty years later, the problem started to accelerate, and today it affects about 1B people. But now we have a line of sight to being able to start to fight back. That’s just remarkable.

So while we may not be where we want to be today. Remember, today is the worst it will ever be. Tomorrow will be even better.

Let’s keep fighting for patients.