Taking the confusion out of insurance

When you're starting a new treatment—especially one as important as GLP-1s for weight loss—you should know what it’ll cost and whether your insurance covers it. Unfortunately, that’s not always the case. Insurance coverage can be confusing. Plans are full of complicated jargon and fine print—and they can change without warning. That often means patients:

Delay or skip care altogether

Get hit with surprise bills they weren’t expecting

We built a tool to fix that. In August 2024, Ro launched the GLP-1 Insurance Coverage Checker—a free tool that gives you helps you understand your coverage right from the start. Using our proprietary technology, the insurance checker is one of the only available tools to help you navigate the hurdles of insurance coverage for GLP-1s.

How it works:

You enter some basic insurance info

You get a personalized report showing which GLP-1 medications are covered

This helps you avoid guesswork and plan your course of treatment alongside your provider with confidence. This tool has already helped over hundreds of thousands of people understand their coverage options. And now, we’re digging into the data to learn even more, so we can continue to expand access and make this process easier for everyone.

What we’ve learned about GLP-1 insurance coverage

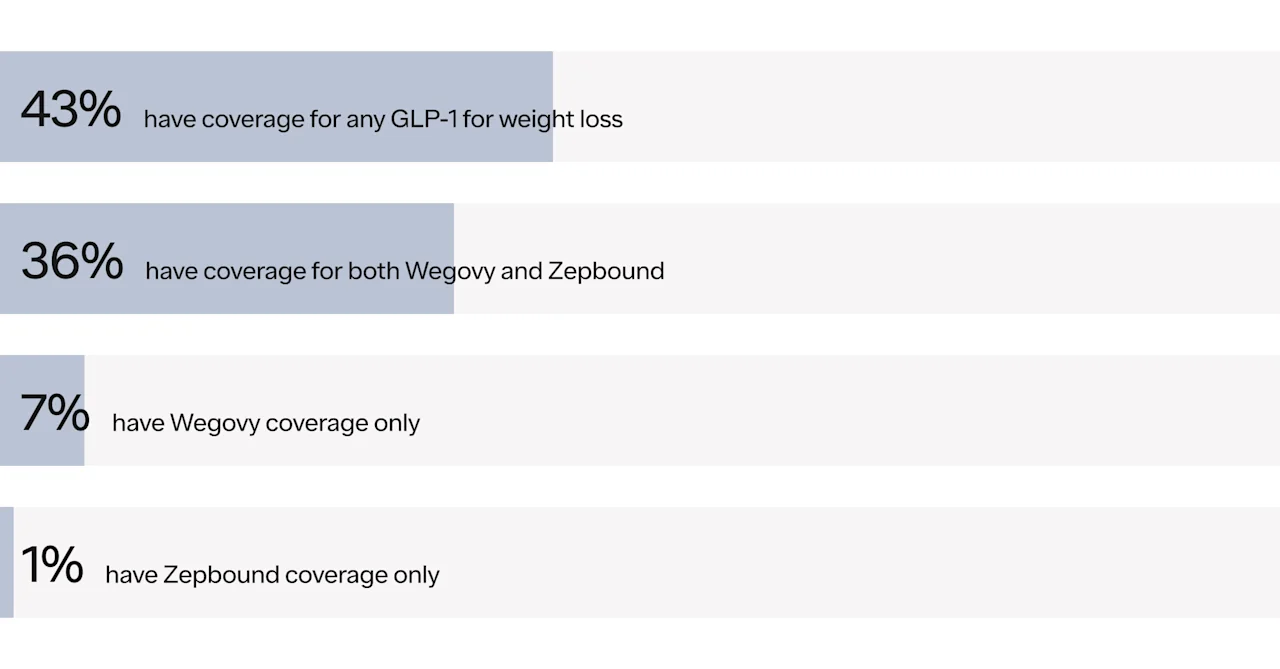

We’ve taken a close look at the data from people who’ve used our GLP-1 Insurance Coverage Checker, and here’s a snapshot of the key findings:

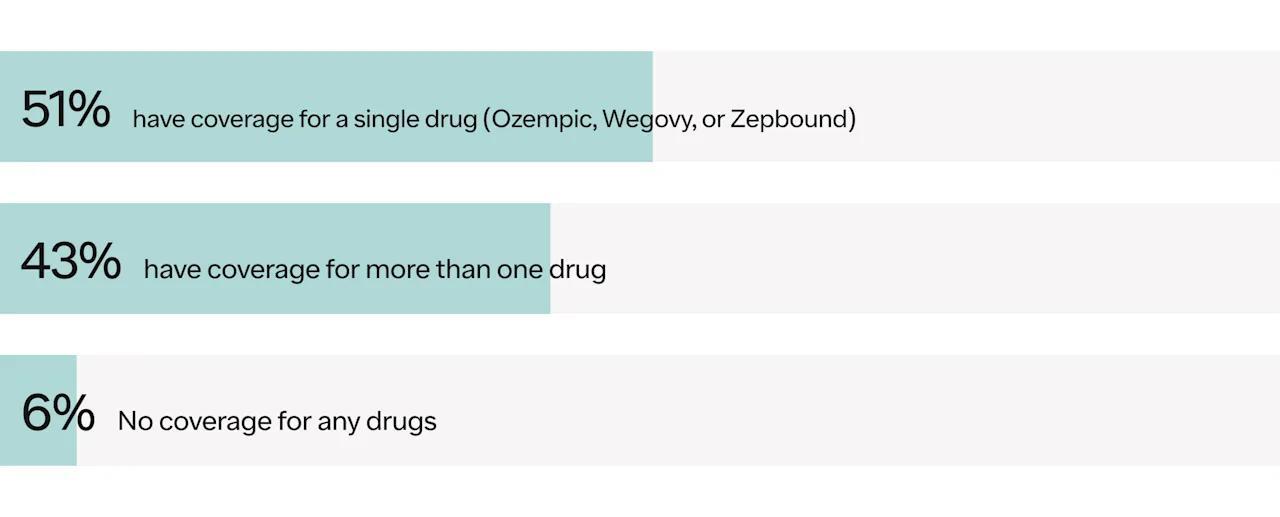

Coverage for GLP-1s: 43% have coverage of a GLP-1 for weight loss, and nearly all have coverage for a GLP-1 for type 2 diabetes (T2D).

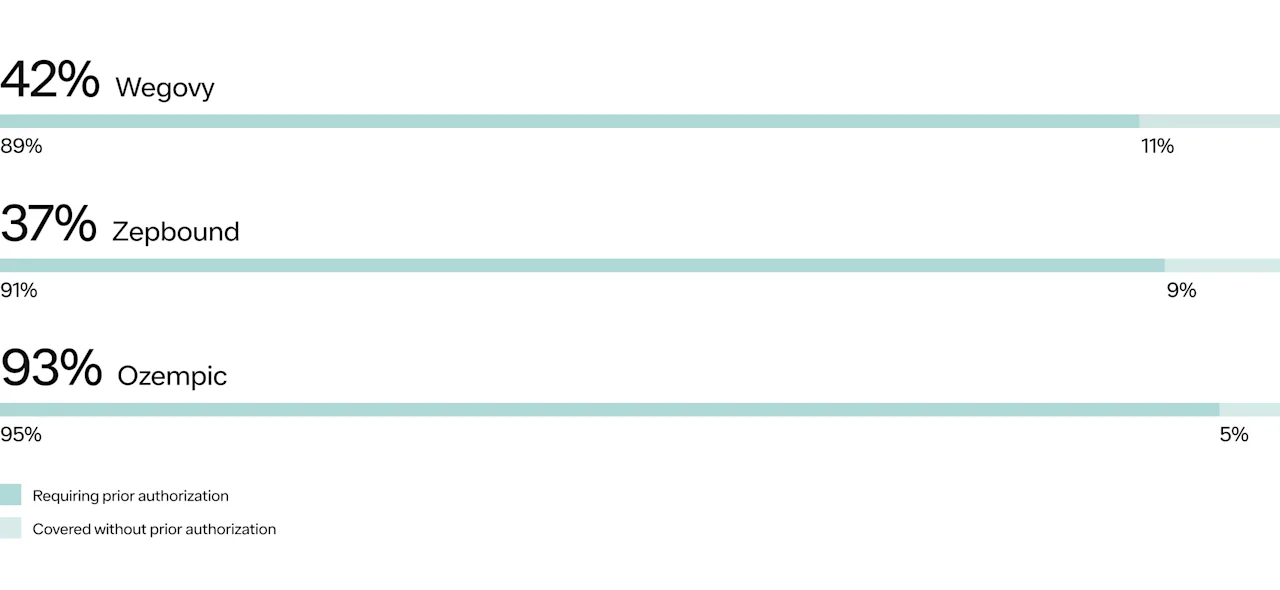

Prior authorization: Even when coverage exists, insurance plans usually ask your doctor to fill out extra paperwork before they’ll approve a medication, which can delay access to treatment.

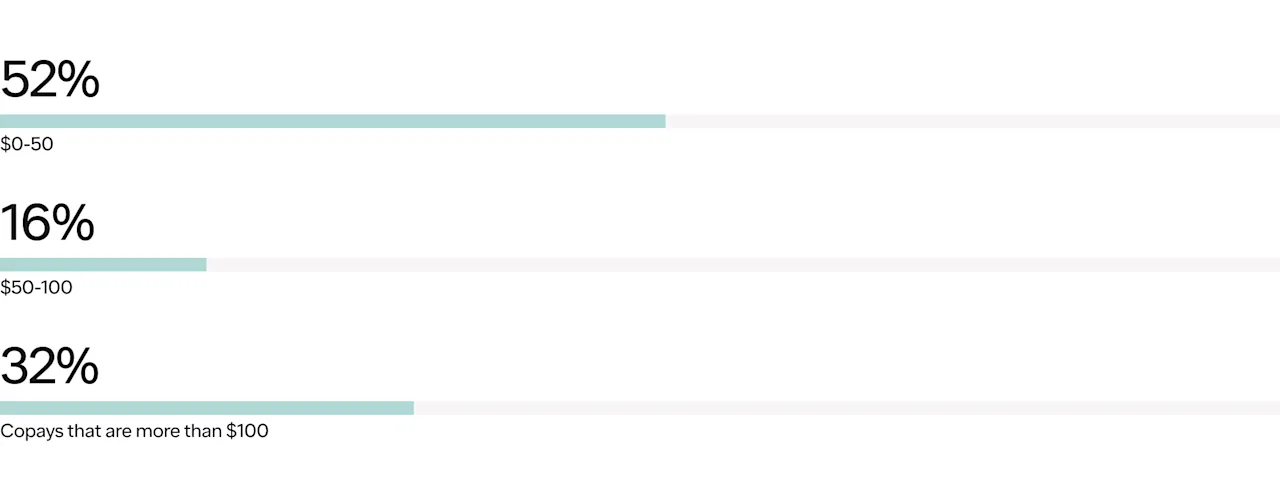

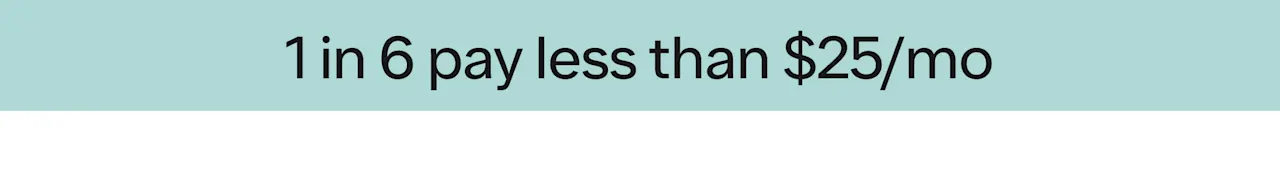

Co-pays: Half of covered patients have a co-pay of $50/mo or less.

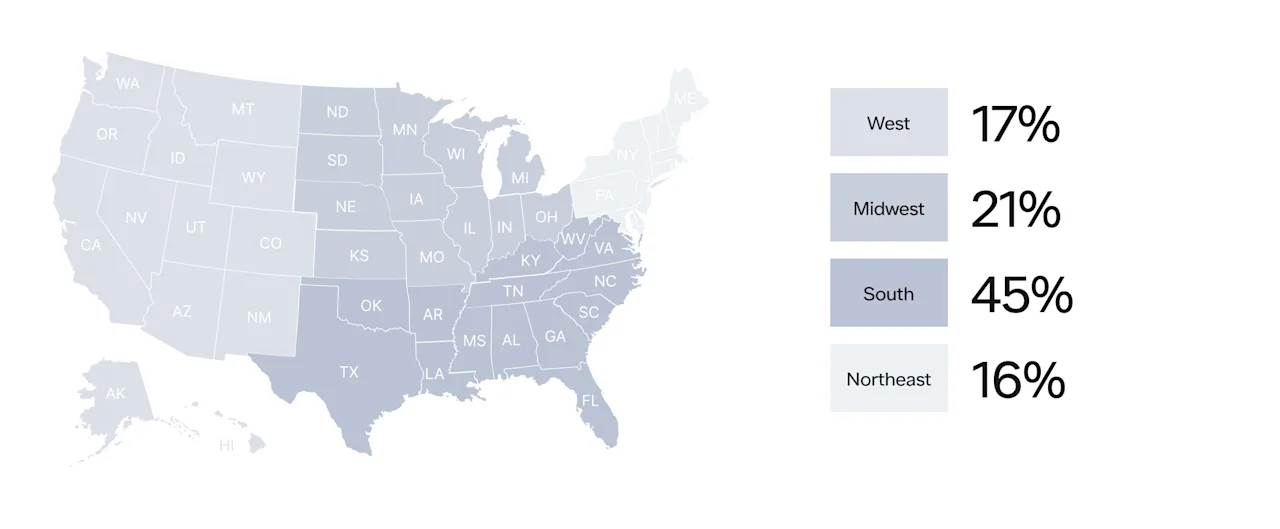

Geographic Distribution: A significant portion of users are located in the Southern states.

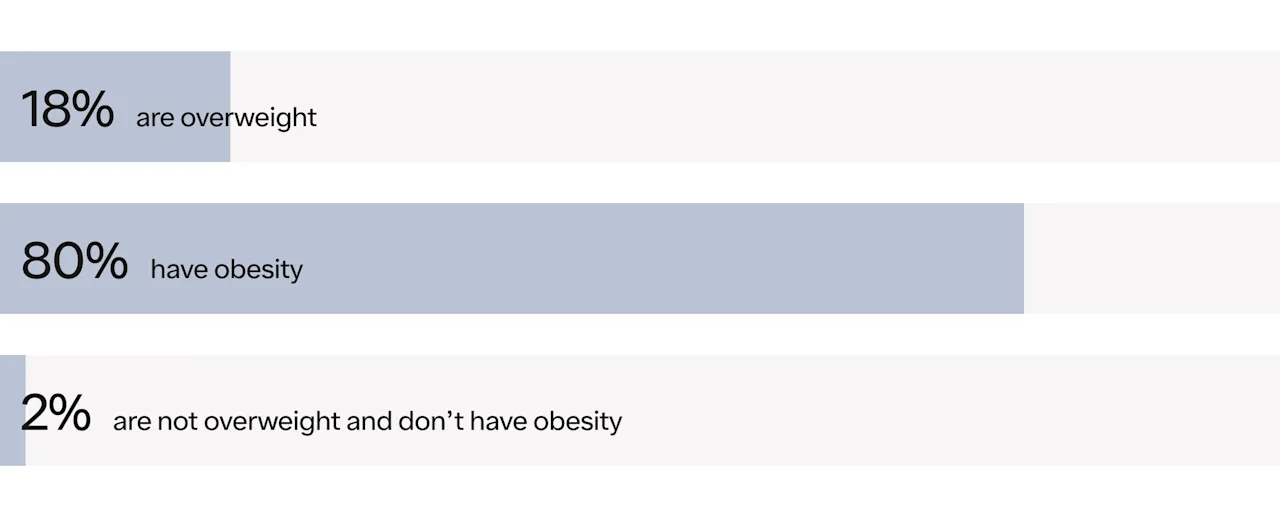

BMI Insights: An overwhelming majority of users have obesity.

So, what does this mean for patients?

It means that coverage is common, but hurdles still exist. We’re working to help make those easier to navigate. Keep reading to explore more insights.

Coverage of GLP-1s for weight loss

Coverage for specific GLP-1s

Breadth of GLP-1s covered

“Ro has been invaluable. Initially, my insurance company covered Wegovy, and I was able to get a prescription and a prior authorization. During the Wegovy shortages, we waited—and waited—for it to come back in stock. While I was waiting, I saw that Ro had started offering Zepbound and contacted my Ro team. They immediately switched my prescription to Zepbound. I had a phone call with one of the physicians, who explained the difference between Zepbound and Wegovy.

We decided to move forward with Zepbound, and the team at Ro jumped into action and got the prior authorizations completed through my insurance. I reached out directly to my pharmacy, and it was fast. All of that happened within about a week of contacting Ro and asking about switching my prescription.”

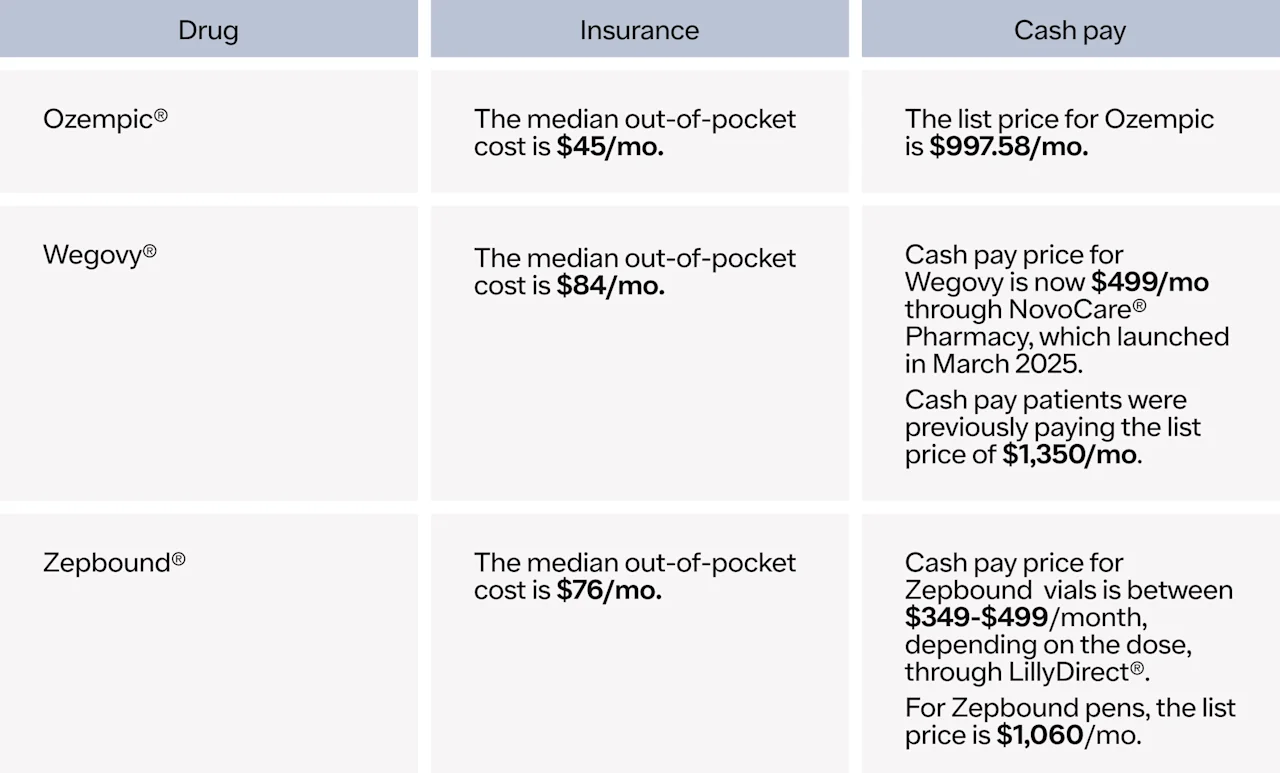

What can patients expect to pay for GLP-1 medication?

Co-pays for GLP-1s can vary, depending on insurance plans. While many patients pay less than $100/mo, others face higher costs. It’s important to note that patients may also need to factor in deductible costs and other plan limits. Final co-pay costs may be not be known until medication pick-up at the pharmacy.

Breakdown of monthly co-pays across branded medications

Member Spotlight

Alyssa

“I could have gone with anyone else, but Ro just spoke to me. It felt like, ‘We're here for you.’ I initially thought I had to pay $1,000 for my medication so I sat on starting my journey for a couple of months. I decided to reach out to Ro to see if the medication cost could be lowered. Within two days, Ro ran my prior authorization and guided me to a savings card. When I went to CVS to pick up my prescription, it was just $25.”

Paid partner

Who's using our Insurance Checker?

Regional

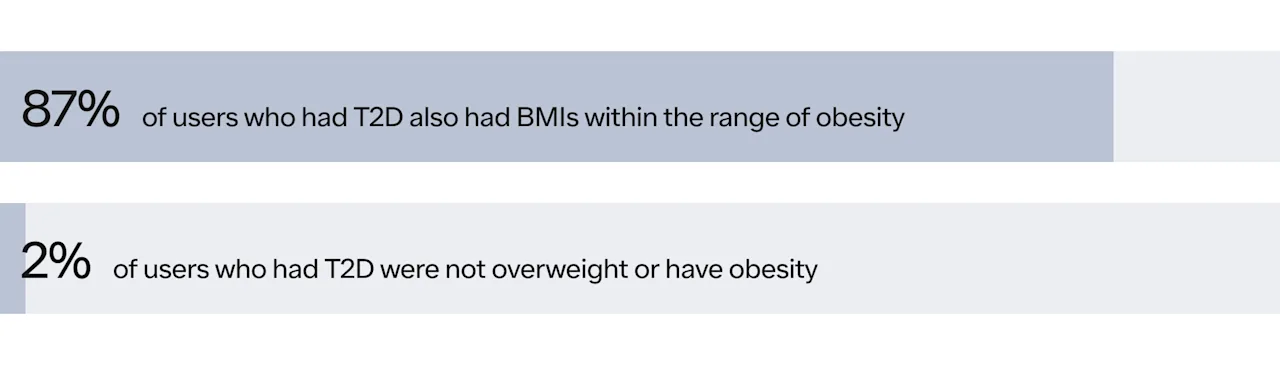

People with overweight, all classes of obesity, and T2D — spotlighting the frequent concurrence of the two conditions

Obesity x T2D overlap

Wegovy and Zepbound are not FDA-approved to treat type 2 diabetes, but in clinical trials, in addition to losing weight, patients saw improvements in blood glucose levels. Ozempic is FDA-approved to treat type 2 diabetes, in conjunction with diet and exercise changes.

Member Spotlight

Jared

“Before I started taking GLP-1 medication through Ro, I was prediabetic and on my way toward Type 2 diabetes. My weight was out of control, and I had struggled for many years to bring it down—with little success. I joined Ro because I had seen friends living with Type 2 diabetes lose weight, lower their A1c levels, and get a new chance at a healthier, happier life with GLP-1s. I couldn't be happier with the success I’ve had with Ro by my side. I’ve lost 48 pounds in a year, my A1c levels have dropped to a healthy range, and my primary care physician took me off my diabetes medication and commended me on my weight loss journey. I’m confident I’ll continue this success knowing I have the support of an amazing team of doctors and nurses at Ro!”

Paid partner

2024 vs 2025

Many people with insurance can get GLP-1 medications like Wegovy, Zepbound, or Ozempic with manageable monthly co-pays. But that’s not true for everyone.

As demand for these medications has grown, so have out-of-pocket costs—even for folks who do have coverage. That means some patients are now paying more, making treatment harder to afford.

At the same time, cash-pay options have fallen significantly. For example:

Zepbound vials are available through Ro’s integration with LillyDirect for $349–$499/mo, depending on the dose

Wegovy is available through Ro’s integration with NovoCare for $499/mo

These price shifts underscore why Ro is working so hard to make it easy for patients to understand their options through tools like the GLP-1 Insurance Coverage Checker.

Median co-pays (2024 → 2025)

Cash price (2024 → 2025)

Fighting for patients: advocating for broader access to GLP-1s

Yes, insurance can be complicated. But here’s the good news: getting access to life-changing treatments like GLP-1s is more possible than many people realize.

At Ro, we’re working to take the stress and guesswork out of the process. We’re making it easier to:

Understand what your insurance covers

Learn your potential costs upfront

Make informed decisions about your treatment

We built the GLP-1 Insurance Coverage Checker to help you take control of your care—not get stuck in a maze of paperwork or confusing coverage rules. Plus, patients who sign up for a Ro membership are supported by an insurance concierge who can help navigate further steps in the insurance coverage process, like submitting prior authorization requests and finding out estimated co-pays.

Try it out for yourself, or share it with someone who might benefit. No matter your insurance situation, Ro offers support and treatment options to help you move forward.

We got you.

These insights are based on Ro's GLP-1 Insurance Coverage Checker user data between August 13, 2024 - April 17, 2025.

Important Safety Information:

GLP-1 medications may have serious side effects. See Important Safety Information, including Boxed Warning, at https://ro.co/safety-info/glp1/.