Key takeaways

Most commercial insurance plans won’t cover brand-name Viagra, but they may be more likely to cover the generic version of the drug (sildenafil).

Your insurance plan likely has a drug formulary available online that can help you figure out which drugs are covered and under what circumstances.

If your insurance plan doesn’t cover Viagra or sildenafil, you can likely get sildenafil very cheaply out of pocket. You can also find out if your plan will cover other ED medications, like Cialis (tadalafil) instead.

Here's what we'll cover

Here's what we'll cover

Here's what we'll cover

Key takeaways

Most commercial insurance plans won’t cover brand-name Viagra, but they may be more likely to cover the generic version of the drug (sildenafil).

Your insurance plan likely has a drug formulary available online that can help you figure out which drugs are covered and under what circumstances.

If your insurance plan doesn’t cover Viagra or sildenafil, you can likely get sildenafil very cheaply out of pocket. You can also find out if your plan will cover other ED medications, like Cialis (tadalafil) instead.

If you're looking to try Viagra to treat erectile dysfunction (ED), you might be surprised by what a big dent this little blue pill can make in your wallet. For just 10 pills, you’re likely looking at paying over $800 out of pocket. So, let’s answer your burning question: Is Viagra covered by insurance? In all likelihood, no.

That may sound crazy, since ED is a medical condition with far-reaching impacts on your health and quality of life. But unfortunately, most plans don’t seem to cover brand-name Viagra (you’ll have to check your specific insurance plan, though, since every plan is different).

Don’t worry, there’s good news: Even if your plan does not include Viagra, cheaper alternatives to Viagra are available, including generic sildenafil. Continue reading to learn more about the cost and coverage of ED medication.

Is Viagra covered by insurance?

Most large commercial health insurance plans (e.g. Aetna, Anthem, Cigna, etc.) cover ED treatments when deemed medically necessary. But that generally doesn’t include brand-name Viagra, an expensive drug that can cost thousands a year out of pocket. Many insurers (e.g. Aetna or Cigna) may be more likely to cover the generic version of Viagra, sildenafil, which costs pennies in comparison.

Your health insurance plan likely has a drug formulary available online, which lists the drugs it covers, in what doses, and under what circumstances.

Some insurance plans may require prior authorization for specific medications, such as Viagra. (Reminder: Prior authorization is when your insurance company requires approval before covering the cost of certain medications, treatments, or procedures.)

Your plan may also limit how much they cover. For example, many plans have a quantity limit of 4–8 tablets per month for sildenafil and similar ED medications.

It’s a good idea to check the drug formulary and call your insurance provider to verify your coverage, since information online may not always be up to date.

If you’re lucky enough to have insurance coverage for Viagra (or any other ED medication), you may still need to pay a copay, or coverage may only go into effect after meeting your deductible. Every plan is different.

Does insurance cover any ED medications?

If your insurance plan doesn’t cover brand Viagra, it may cover other ED medications under certain circumstances.

Viagra was the first of its kind on the market. But it’s just one of a few medications that belong to the drug class called phosphodiesterase-5 inhibitors (PDE5 inhibitors for short). Your insurance plan may not cover any of these, but it’s worth checking to see whether any are covered if Viagra is not.

Other PDE5 inhibitors include:

Sildenafil (this is the active ingredient in and generic version of Viagra)

Again, every insurance plan is different. Your plan may cover some of these drugs and not others. It may also only cover certain indications. For example, Cialis (tadalafil) can be used to treat ED, but it’s also approved to treat benign prostatic hyperplasia or BPH (aka enlarged prostate). In some cases, your insurance may be more likely to cover the medication for BPH.

If your insurance provider covers certain medications but not others, speak with your healthcare provider to see if switching to a covered medication makes sense for you.

Generic sildenafil vs. brand-name Viagra

We’ve mentioned a few times that your insurance plan might be more likely to cover the generic version of Viagra, sildenafil. This is for one simple reason: Generic medications are generally a fraction of the cost of brand-name drugs, and your insurance company will likely want to spend the least amount of money it can.

But what’s the difference between generic sildenafil and brand-name Viagra? Here are the basics:

Active ingredient: Sildenafil is the active ingredient in Viagra, so the generic and brand-name versions work the same way in the body.

Cost: Brand-name drugs, like Viagra, are much more expensive than their generic counterparts. This is largely because generic versions are copies of branded drugs, so they do not have to go through the same extensive (and expensive!) drug development process that drugs need to go through for initial approval by the US Food and Drug Administration (FDA).

Dosages: Viagra is available in 25 mg, 50 mg, or 100 mg tablets. Sildenafil can be dosed a little differently, since it’s also available in forms that treat another condition (more about this later).

Appearance: While Viagra is known as the “little blue pill,” sildenafil tablets can come in many different colors, sizes, and shapes.

If your insurance doesn’t cover Viagra or sildenafil, the good news is that generic sildenafil is quite affordable out of pocket.

How much is Viagra with insurance?

If your insurance covers Viagra, your out-of-pocket cost will depend on your plan’s copay, deductible (or coinsurance), and out-of-pocket maximum.

Here’s a little primer on what these terms mean, according to Healthcare.gov:

Copay: This is a fixed amount, usually listed on your insurance card, that you pay every time you pick up your prescription. Some plans have no copayment, so check your plan.

Coinsurance/deductible: Many plans have a deductible, where generally, you cover 100% of costs until you hit that set amount. After you hit your deductible, you’ll share the cost of covered services with your insurance company, which is called coinsurance.

Out-of-pocket maximum: This is the maximum amount of money you’ll pay out-of-pocket during your year of coverage. Your copays, coinsurance, and deductible generally count toward this total, and once you hit that maximum for the year, your insurance will fully cover any other covered services.

With all that information, you can probably imagine how varied your cost for Viagra might be, even if your insurance covers it. It really depends on the details of your plan and your usage.

It’s also important to note that your insurance may provide better coverage for generic Viagra — aka sildenafil — or other PDE5 inhibitors, like Cialis (tadalafil).

How much is Viagra without insurance?

Without insurance, Viagra can cost over $2,500 for 30 pills of a 100 mg dose (lower doses are generally less expensive). Every pharmacy offers its own rates, though, so it's worth shopping around.

Compare this to sildenafil, which has the same active ingredient as Viagra, and generally costs $20 or less for the same number of pills at the same dose. Generic drugs don’t have to go through the same rigorous FDA-approval process as their branded counterparts, which helps keep costs down.

Other brand-name PDE5 inhibitors may be slightly more affordable but still pricey. Similar to Viagra, the cash price for Cialis varies widely based on the dose. For the lowest dose (2.5 mg), Cialis generally costs around $350 for 30 pills. The highest dose (20 mg) of the brand-name drug can cost over $1,500. The average retail price for Stendra, a less commonly prescribed medication for ED, is around $1,500 out-of-pocket.

Telehealth options, such as Ro, can help you access Viagra or a generic (if appropriate) for a lower cost and have it delivered directly to your door.

Does Medicare cover Viagra?

Most Medicare plans don’t seem to cover Viagra, though prescription coverage varies across these plans. You’ll need to check your plan specifically, which you can do through the Medicare website’s handy tool.

Medicare drug coverage, more commonly referred to as Medicare Part D, only covers medications considered medically necessary. Unfortunately, these plans have not caught up to the now widely accepted reality that sexual health is health. As such, they do not consider treating sexual dysfunction to be a medical necessity, and you’re unlikely to have coverage.

Some plans may cover sildenafil (as generic Revatio) instead. However, this may only be the case if it’s prescribed for a condition called pulmonary arterial hypertension (PAH).

Does Medicaid cover Viagra?

Medicaid plans generally do not cover ED medications like Viagra. New York Medicaid, for example, does not cover Viagra or any ED treatments. Medicaid usually only covers sildenafil when deemed medically necessary for PAH. Your state likely has its Medicaid-approved drug list accessible online, where you can look up what’s covered under your plan.

Sildenafil and Revatio: cheaper alternatives to Viagra

There are two cheaper versions of Viagra available: generic Viagra or sildenafil and generic Revatio. Both drugs have the same active ingredient as Viagra: sildenafil citrate.

Revatio is an FDA-approved medication for treating PAH, a specific type of high blood pressure in the lungs.

Viagra and its generic version sildenafil come in 25 mg, 50 mg, and 100 mg tablets.

Revatio is dosed differently. In addition to an oral liquid and injectable form, it comes in 20 mg tablets. Some healthcare providers prescribe generic Revatio at doses of 20 mg, 40 mg, 60 mg, 80 mg, or 100 mg to treat ED. However, this is considered off-label prescribing since Revatio and its generic form are not specifically FDA-approved for ED.

The generic versions of these drugs are much more affordable alternatives to Viagra. They’re available for as little as under $20 for 30 doses of 100 mg, depending on the pharmacy.

How to purchase Viagra

Viagra and other PDE5 inhibitors are only available by prescription, which means you can’t purchase Viagra over the counter. Rather, you need a prescription from a licensed healthcare provider to get the drug.

If you consistently have trouble getting or maintaining an erection, it’s simple to get a prescription for ED. You’ll just need to have an open and honest conversation with your healthcare provider about your symptoms. You can speak with your primary care provider, or if you feel more comfortable getting treatment online, you can explore telemedicine options, like Ro.

Be sure to get your prescription from a reputable provider and pharmacy. There is, unfortunately, a lot of counterfeiting when it comes to online sales of “Viagra.” Tested samples of counterfeit Viagra have been found to contain pesticides, drywall, commercial paint, and printer ink.

How to save on Viagra or sildenafil if it’s not covered

If your insurance plan does not cover Viagra, you have other options to get ED treatment without breaking the bank.

1. Switch to the generic version

Your insurance plan (or Medicare plan) might be more likely to cover sildenafil (the generic version of Viagra) than the brand due to the big difference in cost. Even if they don’t, sildenafil is typically an inexpensive medication, generally $20 or less for 30 pills at the standard dose when paying out of pocket. Since sildenafil is a drug you take as-needed, not necessarily every day, your out-of-pocket costs should be fairly affordable.

2. Take advantage of savings programs

Set on taking the brand-name version? Viagra’s manufacturer offers a savings program that can save you significant amounts of money (up to 50% for a year) if you qualify. The eligibility requirements include confirming:

You don’t have coverage through any federal health insurance program.

You are not receiving Social Security or disability benefits.

You have no military duty health coverage.

You’re over 18, but you and your spouse or partner are not yet over 65 and retired.

3. See if your insurance will cover a different drug

In some cases, your insurance company might cover another PDE5 inhibitor, like Cialis, particularly if you have an enlarged prostate. Cialis works very similarly to Viagra, but comes in both an as-needed option and a daily option. The main difference between the drugs is that Viagra stays effective in the body for up to four hours, while Cialis can stay active for up to 36 hours.

If your insurance plan covers another drug instead of Viagra, speak to your healthcare provider about getting a prescription for a covered medication instead.

4. Explore other drug formulations

Certain PDE5 inhibitors can be found in other formulations, and these non-pill options may be more affordable. (Not to mention, of course, they might even fit your lifestyle better.) These include:

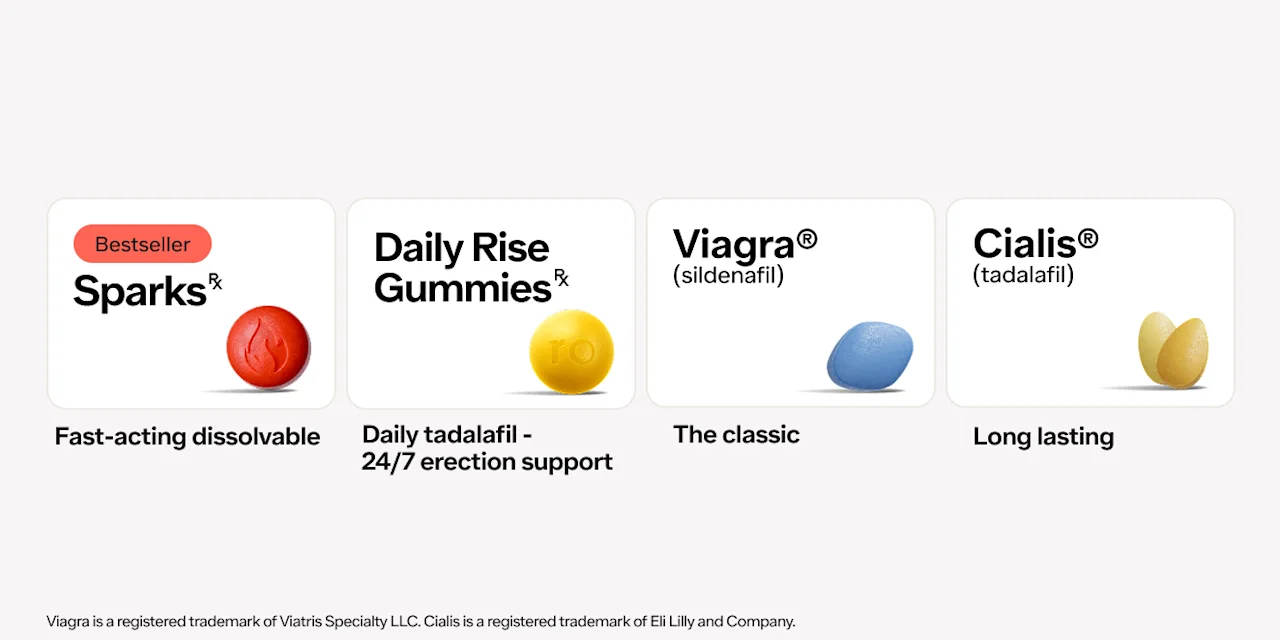

Ro Sparks: A dissolvable tablet that combines sildenafil and tadalafil (the active ingredients in Viagra and Cialis, respectively) for fast-acting, long-lasting treatment. Seriously, it starts working in just 15 minutes and stays active in your system for up to 36 hours.

Daily Rise Gummies: Fruit-flavored gummies that contain tadalafil and are meant to be taken daily, so you’re ready for sexual activity 24/7 (think: more spontaneity).

Bottom line

Brand-name Viagra can be an expensive drug, so it makes sense to wonder if you can expect your insurance plan to cover it. Here’s the brass tacks:

Every insurance plan is different, but most don’t seem to cover brand-name Viagra, which can cost thousands out-of-pocket for 30 pills.

The good news is your insurance plan may cover the generic version of Viagra, sildenafil citrate, instead.

Even if your insurance plan does not cover sildenafil, this generic drug is very affordable, costing about 100 times less than brand-name Viagra out-of-pocket.

Your insurance plan may also be more likely to cover similar drugs, like Cialis. Contact your insurance provider to find out about your coverage.

DISCLAIMER

If you have any medical questions or concerns, please talk to your healthcare provider. The articles on Health Guide are underpinned by peer-reviewed research and information drawn from medical societies and governmental agencies. However, they are not a substitute for professional medical advice, diagnosis, or treatment.

Viagra Important Safety Information: Read more about serious warnings and safety info.

Cialis Important Safety Information: Read more about serious warnings and safety info.

References

Aetna. (2025). 2025 Aetna pharmacy drug guide. Aetna Standard Plan. Retrieved from https://www.aetna.com/content/dam/aetna/pdfs/aetnacom/individuals-families-health-insurance/document-library/pharmacy/2025-Drug-guide-Aetna-Standard-Plan.pdf

Anthem Provider News. (2023). Existing New York State Medicaid policy for drugs, supplies, and procedures used for sexual or erectile dysfunction. Retrieved from https://providernews.anthem.com/new-york/articles/existing-new-york-state-medicaid-policy-for-drugs-supplies-15093

Blue Cross Blue Shield. (2021). “Blue Cross Clinical Drug List - January 2021.” Retrieved from https://www.bcbsm.com/content/dam/public/Consumer/Documents/help/documents-forms/pharmacy/clinical-drug-list-formulary.pdf

Brock, G., Ni, X., Oelke, M., et al. (2016). Efficacy of Continuous Dosing of Tadalafil Once Daily vs Tadalafil On Demand in Clinical Subgroups of Men With Erectile Dysfunction: A Descriptive Comparison Using the Integrated Tadalafil Databases. The Journal of Sexual Medicine, 13(5), 860–875. doi: 10.1016/j.jsxm.2016.02.171. Retrieved from https://pubmed.ncbi.nlm.nih.gov/27114197/

Burnett, A. L., Edwards, N. C., Barrett, T. M., et al. (2020). Addressing health-care system inequities in the management of erectile dysfunction: a call to action. American Journal Of Men's Health, 14(5), 1557988320965078. doi: 10.1177/1557988320965078. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC7557698

Centers for Medicare & Medicaid Services. (2016). Medicare Prescription Drug Benefit Manual Chapter 6 – Part D Drugs and Formulary Requirements. Retrieved from https://www.cms.gov/medicare/prescription-drug-coverage/prescriptiondrugcovcontra/downloads/part-d-benefits-manual-chapter-6.pdf

Cigna. (2025). 2025 Cigna Healthcare Comprehensive Formulary (List of Covered Drugs or “Drug List”). Retrieved from https://www.cigna.com/static/www-cigna-com/docs/medicare/plans-services/2025/formulary-mapd.pdf

Croom, K. F. & Curran, M. P. (2008). Sildenafil: a review of its use in pulmonary arterial hypertension. Drugs, 68(3), 383–397. doi: 10.2165/00003495-200868030-00009. Retrieved from https://pubmed.ncbi.nlm.nih.gov/18257613/

Dhaliwal, A. & Gupta, M. (2023). PDE5 inhibitors. StatPearls. Retrieved from https://www.ncbi.nlm.nih.gov/books/NBK549843/

Goldberg, R. B. (2020). Managing the Pharmacy Benefit: The Formulary System. Journal of Managed Care & Specialty Pharmacy, 26(4), 341–349. doi: 10.18553/jmcp.2020.26.4.341a Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC10391211/

Gong, B., Ma, M., Xie, W., et al. (2017). Direct comparison of tadalafil with sildenafil for the treatment of erectile dysfunction: a systematic review and meta-analysis. International Urology and Nephrology, 49(10), 1731–1740. doi: 10.1007/s11255-017-1644-5. Retrieved from https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5603624/

GoodRx-a. (2020). Cialis (tadalafil). Retrieved from https://www.goodrx.com/cialis

GoodRx-b. (2020). Levitra (vardenafil). Retrieved from https://www.goodrx.com/levitra?dosage=20mg&form=tablet&label_override=Levitra&quantity=30&sort_type=popularity

GoodRx-a. (2025). Sildenafil (generic drug). Retrieved from https://www.goodrx.com/sildenafil

GoodRx-b. (2025). Stendra (avanafil). Retrieved from https://www.goodrx.com/stendra

GoodRx-c. (2025). Tadalafil (Cialis). Retrieved from https://www.goodrx.com/tadalafil-cialis

GoodRx-d. (2025). Viagra (sildenafil). Retrieved from https://www.goodrx.com/viagra

Healthcare.gov. (n.d.). Glossary. Retrieved from https://www.healthcare.gov/glossary/

Huang, S. A. & Lie, J. D. (2013). Phosphodiesterase-5 (PDE5) Inhibitors In the Management of Erectile Dysfunction. P & T : A Peer-Reviewed Journal for Formulary Management, 38(7), 407–419. Retrieved from https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3776492/.

Jackson, G., Arver, S., Banks, I., & Stecher, V. J. (2010). Counterfeit phosphodiesterase type 5 inhibitors pose significant safety risks. International Journal of Clinical Practice, 64(4), 497-504. doi: 10.1111/j.1742-1241.2009.02328.x. Retrieved from https://pubmed.ncbi.nlm.nih.gov/20088883/

Medicare. (2025). Explore your Medicare coverage options. Retrieved from https://www.medicare.gov/plan-compare

Medicare.org. (2019). Does Medicaid Cover Viagra? Retrieved from https://www.medicare.org/articles/does-medicaid-cover-viagra/

Morales, A. M., Mirone, V., Dean, J., & Costa, P. (2009). Vardenafil for the treatment of erectile dysfunction: an overview of the clinical evidence. Clinical Interventions in Aging, 4, 463–472. doi: 10.2147/cia.s3878. Retrieved from https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2801586/

Smith, B. P. & Babos, M. (2023). Sildenafil. StatPearls. Retrieved from https://www.ncbi.nlm.nih.gov/books/NBK558978/

United Healthcare. (2025). Copay, coinsurance and out-of-pocket maximum. Types of Health Insurance Costs. Retrieved from https://www.uhc.com/understanding-health-insurance/understanding-health-insurance-costs/types-of-health-insurance-costs/copay-coinsurance-and-out-of-pocket-maximum

United Healthcare. (2025). 2025 Prescription Drug List. Retrieved from https://www.uhcprovider.com/content/dam/provider/docs/public/resources/pharmacy/commercial-pdl-jan-2025.pdf

U.S. Food and Drug Administration (FDA). (2024). Prescribing Information: Revatio (sildenafil). Retrieved from https://www.accessdata.fda.gov/drugsatfda_docs/label/2024/021845Orig1s028lbl.pdf

U.S. Food and Drug Administration (FDA). (2018). The Drug Development Process. Retrieved from https://www.fda.gov/patients/learn-about-drug-and-device-approvals/drug-development-process

U.S. Food and Drug Administration (FDA). (2017). What Is the Approval Process for Generic Drugs? Retrieved from https://www.fda.gov/drugs/generic-drugs/what-approval-process-generic-drugs

Viatris. (2024). Your savings, your way. Viagra. Retrieved from https://www.viagra.com/savings