Here's what we'll cover

Here's what we'll cover

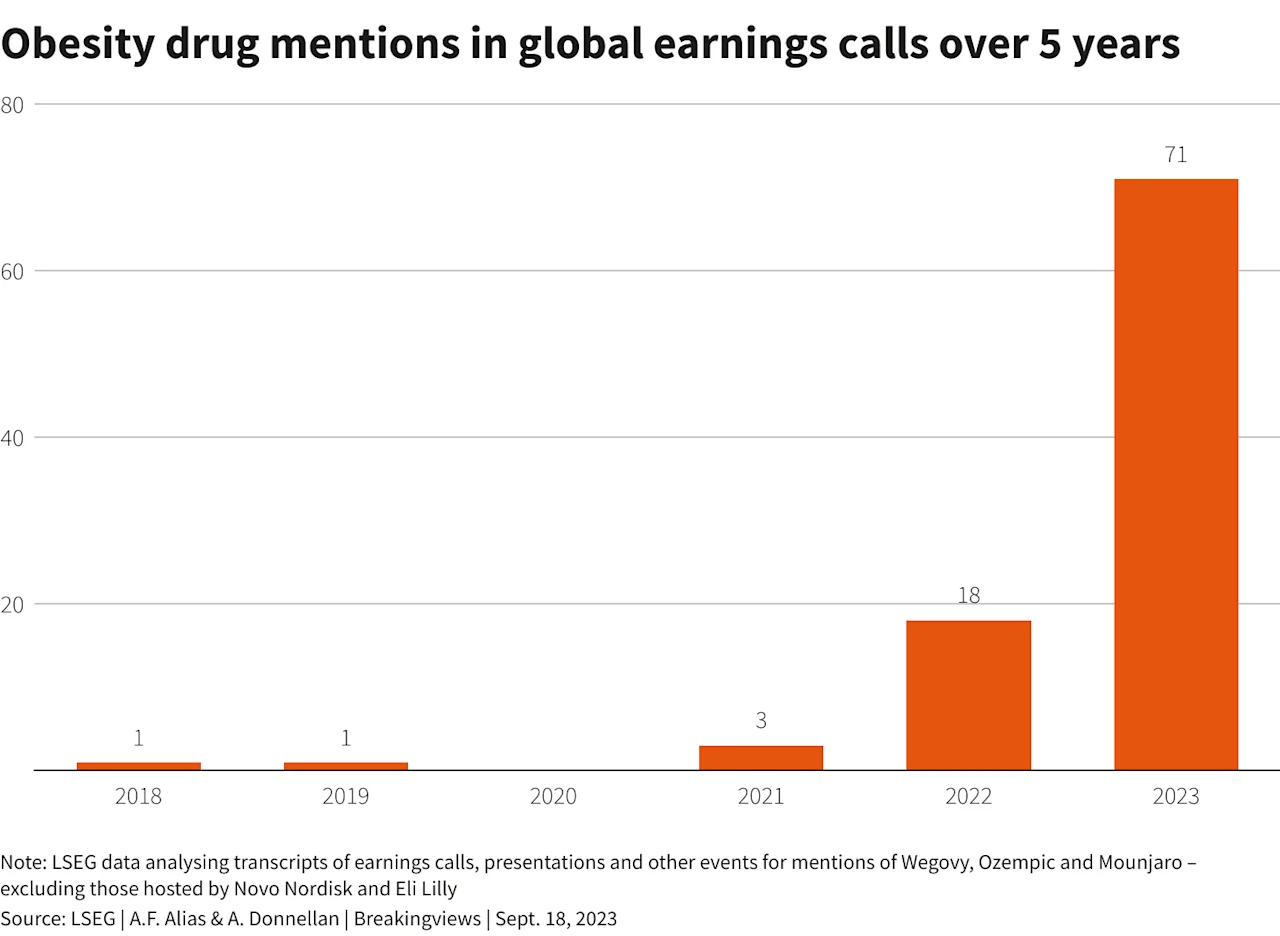

At risk of stating the obvious, GLP1 agonists have taken over the zeitgeist — from jokes at the Oscars, to standing ovations at diabetes and obesity medical conferences, to mentions in quarterly earnings calls across the globe. And there are even more effective treatments on the horizon (e.g., patients losing 25–30% of their body weight, experiencing more significant improvements in underlying biomarkers like A1C, LDL, BP, and benefitting from improvements in their quality of life). We have only begun to see the impacts. I think the rise of this revolutionary new treatment is akin to hundreds of millions of butterflies flapping their wings — small changes resulting in massive, impossible to predict, far reaching ramifications.

In this post, I will explore what those changes might be. My only hope is that this post stimulates an interesting conversation between you and your friends simply by asking — “what happens if…?” or “what happens when…?” Much of the impact discussed below depends on the number of new patients who adopt these new treatments, the rate of adoption, the strength of opposing forces, and the speed of responses of the different impacted parties (e.g., individuals, companies, governments etc.). None can be predicted with any certainty. I simply want to share what I’ve read and try to provide a framework to think about the cascading ripple effects of GLP1s. I hope it’s as interesting to read as it was to write.

The big three: healthcare delivery, consumption, lifestyle

There are many ways to break down the ripple effects of GLP1s (industry, market size, geography, etc.). The most helpful lens for me is to think about it through the lens of the patient and extrapolate from there. Broadly speaking, I think there are three big buckets:

Healthcare Delivery: What healthcare products and services are needed more or less with the rise of GLP1s?

Consumption: How will eating behaviors change, and what will be the cascading effect, from restaurant menus to the supply chain?

Lifestyle: How will behaviors change (beyond consumption)?

There are 650 million adults globally and 110m+ adults in the United States that have obesity. These numbers have been rising for the last 40+ years. Based on a recent survey, approximately 4% of adults are currently taking anti-obesity medications (AOMs). What happens if that number rises to 10%, 25%, 50% or more over the next 5, 10, 25 years?

One big caveat: The data points below are sourced from a mix of surveys, retrospective studies, randomized control trials, and industry research reports — the links between them are not causal (far from it). I raise them as data points for food for thought (i.e., potential weights and counterweights to whether GLP1s will increase or decrease certain outcomes).

Let’s explore!

Healthcare

The combination of obesity’s prevalence and its potential negative impact on patients means that any significant change in the trajectory for these patients can lead to a fundamental shift in the healthcare products and services needed in this country.

We’ve written extensively about the prevalence of obesity and its consequences (more here), so I’ll keep it brief.

Prevalence:

42% of adults and 20% of children and adolescents have obesity as measured by BMI (CDC)

~50% of US adults will have obesity, and nearly half of them will have severe obesity by 2030 (NEJM study).

Impact:

Contributes to 8 of the 10 leading causes of death in the U.S (risk factor for many diseases, including atherosclerotic vascular disease (causing heart attacks and strokes), type 2 diabetes, arthritis, several types of cancer, and premature death).

Increases the risk of mental health disorders, including anxiety and depression.

Our current healthcare challenges (obesity in particular) are a product of our progress. 120 years ago, we didn’t die from chronic diseases; we died from infectious diseases. Thankfully, we solved many, of course not all, of the things that cause humans to die young. But now, we’ve created new problems. Without making this post about life expectancy (the Washington Post had a great article about this recently), we’re now dying of cancer, cardiovascular disease, hypertension, diabetes, obesity, car accidents, suicide, and opioid addiction.

As it relates to obesity, which is soon to overtake tobacco as the leading preventable cause of cancer (source), there is an evolutionary mismatch between our brain and our environment. So, as it relates just to our environment, (more on the massive role genetics and our brain play in obesity here), a gross oversimplification at the highest level is:

Life used to be exercise, it no longer is

We’ve created hyper palatable, calorie dense, crave-worthy food

We’ve made food cheap (relatively speaking) and remarkably easy to acquire

What happens if we remove the craving part? The hyper palatable, calorie dense, cheaper, more convenient solutions were created in response to demand from consumers. And, sadly, our healthcare system has been trying to keep up ever since. We often blame the healthcare system (and obviously it can improve in many ways) but it’s playing whack-a-mole with chronic disease downstream of an entire economy based on delicious, cheap, convenient, and often ultra-processed food.

So what happens if we can fundamentally reduce the amount and type of food consumed at a population level? One of the most unique parts of GLP1s as a treatment is that they both treat the disease (e.g., obesity, diabetes) and can reduce obesity inducing behavior (unlike medication for hypertension).

What happens if we do it over 10 years? What happens to our healthcare needs and costs?

ICER’s (Institute for Clinical and Economic Review) report on the financial evaluation of GLP1s states, “The health-benefit price benchmark for semaglutide is $7,500 to $9,800 per year” — almost $10,000 per year in health-benefit!

It’s important to note, this analysis was written before the SELECT trial, which showed a 20% reduction in major adverse cardiovascular events among people with prior cardiovascular disease. ICER has announced they are redoing this analysis (likely with a higher health-benefit price) once the full SELECT results are released.

A few areas to think about:

Surgery

How might weight loss with help from GLP1s affect surgical procedures? Losing weight is often a prerequisite for bariatric surgery and often poses a major barrier to qualifying for the procedure, or for its eventual success. Also, conceivably, GLP1s may prove so successful for some patients that bariatric surgery is no longer needed.

Do GLP1s increase eligibility by more or less than they decrease the demand for bariatric surgery?

“ReShape Lifesciences (RSLS) noted that GLP-1s have reduced initial consultations for its LAP-BAND Surgery.” — LastBearStanding on Substack

Teleflex Incorporated, Q2 2023 Earnings Call, Aug 03, 2023: “We continue to monitor the usage of GLP-1 drugs in treating obesity. Based on our market checks, it is our sense that GLP-1s had some impact on bariatric surgery volumes in the second quarter. It remains too early to assess the long-term impact on the market given questions on reimbursement and safety profile.”

Do people need fewer knee or hip replacements as the wear and tear on their joints is reduced?

One study estimated about a quarter of surgical cases involving knees could be avoided if patients weren’t overweight (source).

What happens if there are fewer heart attacks, strokes, or a lesser need for stents and bypasses? The SELECT Trial showed a 20% reduction in MACE (major adverse cardiovascular events) for certain populations. And GLP1s have been shown to reduce atherosclerotic cardiovascular risk in patients with Type-2 Diabetes (source).

Devices

Losing weight may lead to an increase or decrease in the devices needed in the healthcare system.

What happens to insulin pumps? CGM devices? Tracking devices?

Or sleep apnea machines as patients lose weight and sleep better (~70% of patients with sleep apnea have obesity).

From a recent Reuters article, “ResMed CEO Michael Farrell said he thought weight-loss drugs wouldn’t have a major impact on the company’s future sales…Even so, ResMed’s stock has since lost about a third of its value”.

There are countless other devices that might be impacted.

Doctor visits

What types of providers will be seen more, and what types will be seen less? There was a 50% increase in the number of physicians who applied to take the ABOM (American Board of Obesity Medicine) certification exam — what are the other impacts?

Supply chain

What medical products will be needed more? Less? The shortage of GLP1s right now is largely attributed to the manufacturing of pens for the injection. Manufacturers are taking notice of this, and taking action to get a piece of the demand. What else might be impacted? From syringes to autoinjectors to raw materials?

Pharmacy & OTC

What drugs might be prescribed more or less? GLP1s have been shown to lower A1C, lower blood pressure, lower LDL, raise HDL, and improve overall quality of life.

What happens if millions of patients lose significant weight and need less blood pressure medication or can come off certain medications?

What happens if patients who previously were not visiting the pharmacy every month now start? What else will they pick up in line at CVS? What might they stop buying?

“Medifast (MED), a weight-loss meal plan provider, has seen substantial declines in revenue since 2022. This week, while announcing a 35% year-over-year revenue decline in 2Q23, the company acknowledged that GLP-1s are playing a direct role which the company first identified as a factor at the end of last year.” — LastBearStanding

Insurance & PBMS

The costs of GLP1s can be significant. What will happen to health insurance premiums? What will happen to wages as a result of rising employer costs? Can the potential positive downstream impacts of GLP1s outweigh the costs for insurers, employers, patients, and the government? Only time will tell.

A few comments from insurers & PBMs:

UnitedHealth Group Inc, Goldman Sachs Global Healthcare Conference: Jun-13-2023: “They are quite expensive offerings in the marketplace right now. […] I guess I would say, to shorthand it, [employers are] not rushing into these kind of offerings until they understand more. And really, looking -- will we get a better price point in the marketplace, ultimately, on these kind of products?”

The Cigna Group, Q2 2023 Earnings Call, Aug 03, 2023: “GLP-1s are definitely top of mind for many of our clients. There's been a meaningful uptick in utilization here […] We have recently launched a program called InCircle Rx, which brings together management of the GLP-1 cardiac diabetic conditions, obesity. So these conditions often tend to be interrelated, to bring together a benefit plan design, the clinical support as necessary and the overall resources we can bring to help these patients, better manage their health and ultimately get to better plan costs.”

Elevance members’ GLP-1 utilization has been consistent with expectations, and the drugs are benefiting pharmacy benefit managers CarelonRx, CFO John Gallina said.

CVS is also seeing stronger GLP-1 usage that’s creating a yin-and-yang dynamic between its insurance and pharmacy businesses. “We feel like we have priced appropriately for it, so we feel like the risk is manageable,” CVS CEO Karen Lynch said, but in pharmacy services, “it is generating very strong revenue.”

Does it impact insurance premiums vis-a-vis risk scores for ACA and MA plans if a population is generally less burdened by chronic disease? What happens if there is delayed mortality? Will life insurance be impacted? Will the value of whole v.s. term life insurance change?

Government spending

As part of the Medicare Prescription Drug, Improvement, and Modernization Act (MMA) in 2006, Medicare is prohibited from covering ‘weight loss’ medications. While this is indicative of how obesity and its treatment were seen at the time, I believe the sentiment is shifting as our knowledge of obesity improves, and our understanding that obesity is a progressive and relapsing disease worthy of high quality treatments and care grows.

There is currently legislation on the table to authorize Medicare to cover obesity treatments. It’s called the Treat and Reduce Obesity Act (TROA). You can read the bill in its entirety here.

What will happen to Medicare costs if GLP1s are covered? What would happen to our budget? Would the benefits outweigh the costs? The CBO announced on October 5th, 2023, they are looking into research that “would enhance its analysis of policies affecting the use of obesity treatments—especially research on the use of anti-obesity medications (AOMs).” According to a report by the Milken institute, the total cost of chronic diseases due to obesity and overweight was $1.72 trillion—equivalent to 9.3 percent of the U.S. gross domestic product (GDP).

Again, millions of butterflies flapping their wings. It will be very hard to estimate the precise impact. But, if adoption of GLP1s is high, a sizable impact on patients and the healthcare system is undeniable.

Consumption

Everyone from Morgan Stanley, to Reuters, to Jeffries, to the twittersphere has been commenting on the potential changes to purchasing behavior for patients on GLP1s.

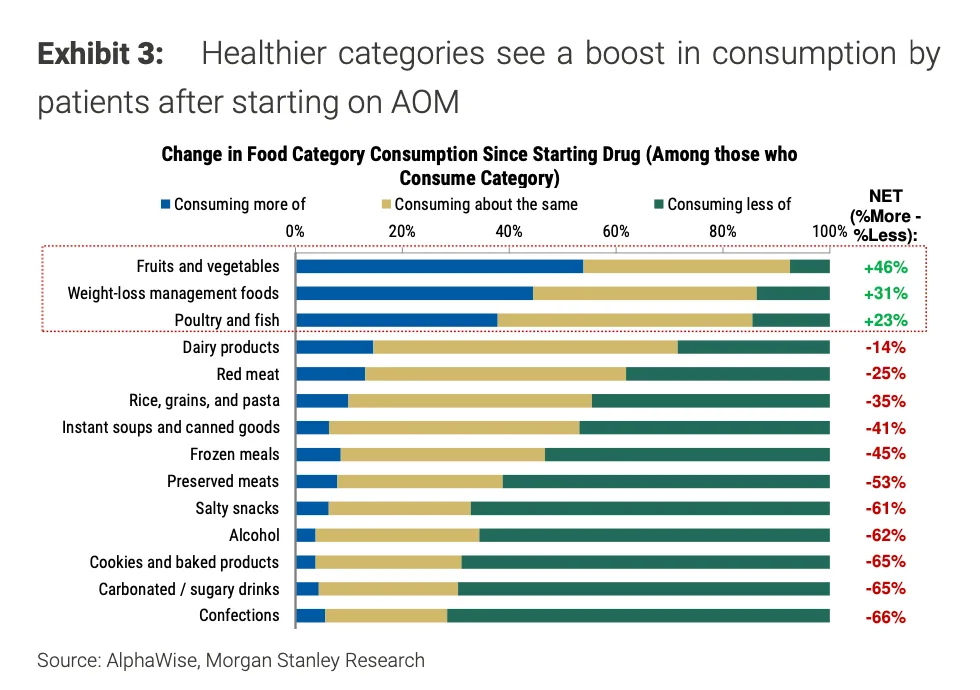

While results vary by patients, a survey conducted by AlphaWise and Morgan Stanley suggests that the average patient reduces their calorie intake by 20–30% and eats 20–40% fewer meals and snacks.

What might happen if millions, tens of millions, or even hundreds of millions of people across the globe eat 20–30% fewer calories and cut the number of meals nearly in half? And then, what if the quantity isn’t the only thing to change but the type of food consumed?

What might happen to restaurants? Grocery stores? Beverage companies? What might be the impact on agriculture? Raw materials?

Some food for thought:

Food & restaurant preferences

Patients on GLP1s:

Ate more: fruits and veggies, weight loss management foods, poultry and fish

Ate less: confections, sugary drinks, cookies, alcohol, etc.

Basically, GLP1s served as a jetpack for positive behavior change!

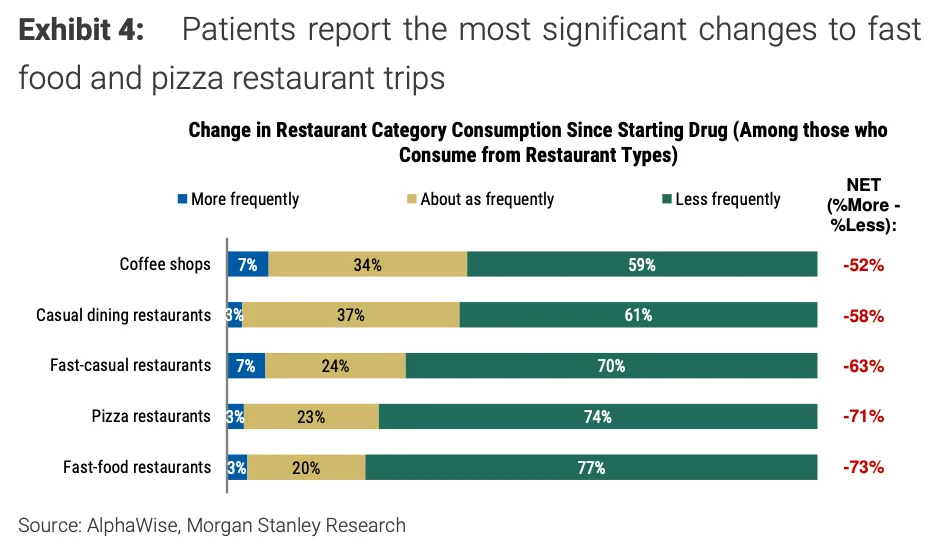

Not only did patients change what they ate, but they visited far fewer restaurants and ate less while going out. “The US restaurant teams' survey of consumers taking GLP-1s showed that 42% of respondents noted a reduction in visiting restaurants and 44% reported eating/ordering less when going out.” (Source: Jeffries Report)

What happens to:

Restaurants with narrow menus that fall in those categories? Will they be impacted? If so, can they change their narrow menu to keep up with new preferences?

Examples: Dunkin Donuts, Krispy Kreme, Wing Stop, Pizza Hut, Dominos

Beverage companies that sell only alcoholic beverages or sugary drinks?

Alcohol consumption is highly concentrated. “In England, for example, 4% of drinkers account for 23% of the industry’s revenue, according to a study in the journal Addiction.” (source)

Will people drink more coffee or water as a result? If so, which and where?

Condiment companies? Hello Heinz. Will people eat less ketchup? Mayo? Ranch dressing?

Confectionary companies?

Nestle is already having to educate people that it sells a lot of water, coffee, baby food (Gerber FTW) and not as many KitKats as people think. “It’s not that we will be immune to it, but we are not that present in what is called the center of the plate because this is about reducing calorie intake, and we are not really very present in the business of calories. If you look at our business, our main business is coffee, not really involved. PetCare, not. Infant Nutrition, not concerned. Water, no either. Culinary, what we do is not really about calories. So where we are a little bit more exposed is certainly with Confectionary, which is a smaller category for us. And obviously, a bit in the U.S. with Frozen and Prepared meals. So we are probably less exposed than most of the industry, I would say.”

Look at the way companies are starting to have to defend themselves and explain their business. “PetCare. Not.”

Grocery stores and major retailers?

Walmart US CEO, John Furner, told Bloomberg on 10/4/23 that they were seeing an impact in purchasing behavior based on the rise of GLP1s. “We definitely do see a slight change compared to the total population. We do see a slight pullback in the overall basket, just less units, slightly less calories”.

Stocks of Pepsi, Coca-Cola, McDonalds, Walmart, Costco were all impacted as a result.

Will people purchase more veggies? More protein bars? Fewer Oreos? Which brands?

Note: Walmart is the 5th largest pharmacy in the US so they also might see benefits.

How could this impact agriculture? What could result from a massive swing over the next 10 years in the quantity and types of food being consumed? What cascading ripple effect could that have through the global supply chain and foreign trade?

Will we purchase fewer grain-based products? Does this impact wheat, corn, soy production?

What happens to the need for certain fertilizers or crop chemicals? Could that have an impact on climate change?

Will we need different types of farm equipment? Will companies like John Deere be impacted?

It’s pretty fascinating to think about the knock-on effect of chopping 20–30% of calories, radically changing the type of food consumed, and then doing this for tens, if not hundreds, of millions of people over the next 10 years. The system we built was built gradually over the last 100 years. What happens if change happens much faster than we think? What happens if the pendulum for certain types of consumption swings hard and fast in the opposite direction?

Lifestyle

When someone’s health improves, and the quantity and type of food changes, there is the potential for a seismic shift in their lifestyle.

What happens to their clothing purchases? What about beauty? Dating? Fitness? Travel? Housing? Entertainment choices?

Again, I don’t know the answer to any of these questions, but I do think millions of people’s behavior will be impacted, and I think it’s interesting to think about how our world might change.

Some food for thought:

Clothes & retailers

After starting GLP1s, people are purchasing:

More: Athleisure, apparel, footwear, casual attire, and intimates/lingerie

Less: Plus-size retailers, luxury apparel and accessories, business casual

So what happens to companies in the “more” bucket like Lululemon, Nike, Victoria Secret? What about the less bucket? Also the “why” is fascinating? Why are people spending less on luxury items? Is it because they are spending more on GLP1s and discretionary income decreases? Is it because they don’t feel the need to anymore?

What about the companies helping make these products? The difference between an L and XL size shirt is ~17% less fabric and 20-25% less fabric weight. “In Asia, there are ~10M people employed in fabric mills meaning a 20% decline in fabric demand could cause 20%+ job losses.” — Jeffries Report. The list goes on.

Beauty

There are changes in an individual’s body composition that occur during most forms of weight loss (e.g., excess skin) and some changes occur as side effects of GLP1s (e.g., thinning hair). How could this affect the beauty industry? Will people purchase more injectables? Microneedles to restore facial volume? Hair loss medication? Collagen supplements? What else changes?

Dating, marriage and sex

The chart above shows a 7% increase in “intimates.” Is it because of a change in body composition? Or are people having more sex? Are they dating more? What does that mean for Tinder, Bumble, Trojan, and Ro?

According to an analysis led by University of Pittsburgh School of Public Health epidemiologists, adults who are not married and get weight-loss surgery are more than twice as likely to get married within five years. Likewise, adults who are married and get bariatric surgery are more than twice as likely to get divorced. However, it’s also important to note that this is “relative percentage increase” — the majority of people in the study did not change their marital status within 5 years of the surgery (i.e., we likely won’t see a massive spike in divorce rates). It’s only one study but it’s an interesting data point nonetheless. Here is a link to the full study.

Fitness

People on GLP1s were twice as likely to exercise (35% versus 71%) after they started taking medication. Again, it’s really amazing to see the cascading impact of these medications (fewer calories, better calorie content, more exercise).

What happens to gym memberships? Exercise equipment? Bikes? Bathing suit purchases? Pool purchases? Pool cleaning services? The rabbit hole is deep. The higher level point is what happens when potentially hundreds of million of people are exercising twice as much?

Travel

What will happen to travel? Will people travel more because they are more active and spending less of their income and time eating at restaurants? Or will they travel less because they have less discretionary income (GLP1s can be expensive).

What will happen to airlines? According to a Jeffries report, there could be a surprisingly large impact on fuel costs if the average passenger was 10lbs lighter.

“Airlines' biggest expense is fuel, which has been exacerbated as jet fuel prices have rebounded. Efforts to take weight out of an aircraft have included everything from carrying less water, to cutting olives from salad, to moving to lower weight beverage carts and shifting to lower weight plates and utensils. The scenario assumes the impact of the average passenger weight dropping by 10 lbs. This example is simplified, but at an average '23 fuel price of $2.89 this equates to an $80M a year savings or 0.7% of overall fuel expenses.”

Would they pass on the savings and decrease the price of tickets? Add more seats? Pocket the savings?

Entertainment

There are reports of people on GLP1s drinking less, online shopping less, and gambling less. The top 20% most engaged gamblers using an online casino operated by the Canadian government made up 92% of revenue and 90% of losses (source).

As we learn more about obesity, we’re learning that it is a neuro-hormonal disease. Your brain plays an incredibly influential role in managing and balancing energy intake and consumption. While the precise effect is unknown, these medications are acting on the reward system of someone’s brain and are currently being studied as a form of anti-addiction treatment to see if they may lead to a decrease in people exhibiting dopamine rich addictive behaviors (e.g., gambling, stock trading, online shopping). Source.

Conclusion

The examples above are just those that are top of mind. I know there are countless more (I’d love to hear your thoughts as well!).

In the end, I’m not sure what exact impact GLP1s will have on our world. I do know that our world has been so significantly shaped by the impact of our drive to consume. From our healthcare system to our food consumption to our sources of entertainment to our global supply chain, all of it has been built around a drive to consume and much of that has had a positive impact (far fewer people are starving today than 100 years ago).

But now that we have significant pockets of excess, what will happen if that trend slows or reverses? Who and what will be impacted? How might life change? How will our healthcare system, the largest industry in our country and 18% of our GDP, evolve? How will restaurants and grocery stores and food manufacturers evolve to match the changing preferences? How has the centrality of food and consumption influenced the way we socialize and spend time with one another? How does that change if the role of food evolves? How does that change if people can move more comfortably? If they can live longer and better?

We’re at the beginning of a Cambrian explosion of invention in cardiometabolic health. While these GLP1s were 20 years in the making, looking at the 80+ GLP1s in Phase 2/3 clinical trials, with both their increased efficacy and potential wide ranging utility beyond diabetes and obesity, I can confidently say…

This is only the beginning of how they will change our world.